- Search Search Please fill out this field.

- Corporate Finance

- Financial statements: Balance, income, cash flow, and equity

Financial Statements: List of Types and How to Read Them

:max_bytes(150000):strip_icc():format(webp)/me_jpeg__chris_murphy-5bfc262746e0fb0051bcea2f.jpg)

What Are Financial Statements?

Financial statements are written records that convey the financial activities of a company. Financial statements are often audited by government agencies and accountants to ensure accuracy and for tax, financing, or investing purposes. For-profit primary financial statements include the balance sheet, income statement, statement of cash flow, and statement of changes in equity. Nonprofit entities use a similar but different set of financial statements.

Key Takeaways

- Financial statements provide interested parties with a company's overall financial condition and profitability.

- Statements required by Generally Accepted Accounting Principles are the balance sheet, the income statement, and the statement of cash flows, but you'll likely see more in reports.

- The balance sheet provides an overview of assets, liabilities, and shareholders' equity as a snapshot in time.

- The income statement primarily focuses on a company's revenues and expenses during a particular period. Once expenses are subtracted from revenues, the statement produces a company's profit figure called net income.

- The cash flow statement (CFS) tracks how a company uses its cash to pay its debt obligations and fund its operating expenses and investments.

Investopedia / Julie Bang

Understanding Financial Statements

Investors and financial analysts rely on financial data to analyze a company's performance and make predictions about the future direction of its stock price. One of the most important resources of reliable and audited financial data is the annual report , which contains the firm's financial statements.

The financial statements are used by investors, market analysts, and creditors to evaluate a company's financial health and earnings potential. The three major financial statement reports are the balance sheet, income statement, and statement of cash flows.

Not all financial statements are created equally. The rules used by U.S. companies are called Generally Accepted Accounting Principles, while the rules often used by international companies are International Financial Reporting Standards (IFRS). In addition, U.S. government agencies use a different set of financial reporting rules.

Balance Sheet

The balance sheet provides an overview of a company's assets, liabilities, and shareholders' equity at a specific time and date. The date at the top of the balance sheet tells you when this snapshot was taken; this is generally the end of its annual reporting period. Below is a breakdown of the items in a balance sheet.

- Cash and cash equivalents are liquid assets, which may include Treasury bills and certificates of deposit.

- Accounts receivable are the amount of money owed to the company by its customers for the sale of its products and services.

- Inventory is the goods a company has on hand, intended to be sold as a course of business. Inventory may include finished goods, work in progress that is not yet finished, or raw materials on hand that have yet to be worked.

- Prepaid expenses are costs paid in advance of when they are due. These expenses are recorded as an asset because their value has not yet been recognized; should the benefit not be recognized, the company would theoretically be due a refund.

- Property, plant, and equipment are capital assets owned by a company for its long-term benefit. This includes buildings used for manufacturing or heavy machinery used for processing raw materials.

- Investments are assets held for speculative future growth. These aren't used in operations; they are simply held for capital appreciation.

- Trademarks, patents, goodwill, and other intangible assets can't physically be touched but have future economic (and often long-term benefits) for the company.

Liabilities

- Accounts payable are the bills due as part of a business's operations. This includes utility bills, rent invoices, and obligations to buy raw materials.

- Wages payable are payments due to staff for time worked.

- Notes payable are recorded debt instruments that record official debt agreements, including the payment schedule and amount.

- Dividends payable are dividends that have been declared to be awarded to shareholders but have not yet been paid.

- Long-term debt can include a variety of obligations, including sinking bond funds, mortgages, or other loans that are due in their entirety in more than one year. Note that the short-term portion of this debt is recorded as a current liability.

Shareholders' Equity

- Shareholders' equity is a company's total assets minus its total liabilities. Shareholders' equity (also known as stockholders' equity ) represents the amount of money that would be returned to shareholders if all of the assets were liquidated and all debts paid off.

- Retained earnings are part of shareholders' equity and are the amount of net earnings that were not paid to shareholders as dividends.

Example of a Balance Sheet

Below is a portion of ExxonMobil Corporation's (XOM) balance sheet for fiscal year 2021, reported as of Dec. 31, 2021.

- Total assets were $338.9 billion.

- Total liabilities were $163.2 billion.

- Total equity was $175.7 billion.

- Total liabilities and equity were $338.9 billion, which equals the total assets for the period.

Income Statement

Unlike the balance sheet, the income statement covers a range of time, which is a year for annual financial statements and a quarter for quarterly financial statements. The income statement provides an overview of revenues, expenses, net income, and earnings per share.

Operating revenue is the revenue earned by selling a company's products or services. The operating revenue for an auto manufacturer would be realized through the production and sale of autos. Operating revenue is generated from the core business activities of a company.

Non-operating revenue is the income earned from non-core business activities. These revenues fall outside the primary function of the business. Some non-operating revenue examples include:

- Interest earned on cash in the bank

- Rental income from a property

- Income from strategic partnerships like royalty payment receipts

- Income from an advertisement display located on the company's property

Other income is the revenue earned from other activities. Other income could include gains from the sale of long-term assets such as land, vehicles, or a subsidiary.

Primary expenses are incurred during the process of earning revenue from the primary activity of the business. Expenses include the cost of goods sold (COGS), selling, general and administrative expenses (SG&A), depreciation or amortization, and research and development (R&D).

Typical expenses include employee wages, sales commissions, and utilities such as electricity and transportation.

Expenses that are linked to secondary activities include interest paid on loans or debt. Losses from the sale of an asset are also recorded as expenses.

The main purpose of the income statement is to convey details of profitability and the financial results of business activities; however, it can be very effective in showing whether sales or revenue is increasing when compared over multiple periods.

Investors can also see how well a company's management is controlling expenses to determine whether a company's efforts in reducing the cost of sales might boost profits over time.

Example of an Income Statement

Below is a portion of ExxonMobil Corporation's income statement for fiscal year 2021, reported as of Dec. 31, 2021.

- Total revenue was $276.7 billion.

- Total costs were $254.4 billion.

- Net income or profit was $23 billion.

Cash Flow Statement

The cash flow statement (CFS) shows how cash flows throughout a company. The cash flow statement complements the balance sheet and income statement .

The CFS allows investors to understand how a company's operations are running, where its money is coming from, and how money is being spent. The CFS also provides insight as to whether a company is on a solid financial footing.

The cash flow statement contains three sections that report on the various activities for which a company uses its cash. Those three components of the CFS are listed below.

Operating Activities

The operating activities on the CFS include any sources and uses of cash from running the business and selling its products or services. Cash from operations includes any changes made in cash accounts receivable, depreciation, inventory, and accounts payable . These transactions also include wages, income tax payments, interest payments, rent, and cash receipts from the sale of a product or service.

Investing Activities

Investing activities include any sources and uses of cash from a company's investments in its long-term future. A purchase or sale of an asset, loans made to vendors or received from customers, or any payments related to a merger or acquisition are included in this category.

Also, purchases of fixed assets such as property, plant, and equipment (PPE) are included in this section. In short, changes in equipment, assets, or investments relate to cash from investing.

Financing Activities

Cash from financing activities includes the cash from investors or banks and the cash paid to shareholders. Financing activities include debt issuance, equity issuance, stock repurchases, loans, dividends paid, and debt repayments.

The cash flow statement reconciles the income statement with the balance sheet in three major business activities.

Example of a Cash Flow Statement

Below is a portion of ExxonMobil Corporation's cash flow statement for fiscal year 2021, reported as of Dec. 31, 2021. We can see the three areas of the cash flow statement and their results.

- Operating activities generated a positive cash flow of $48 billion.

- Investing activities generated cash outflows of -$10.2 billion for the period. Additions to property, plant, and equipment made up the majority of cash outflows, which means the company invested in new fixed assets.

- Financing activities generated cash outflows of -$35.4 billion for the period. Reductions in short-term debt and dividends paid out comprised most of the cash outflows.

Statement of Changes in Shareholder Equity

The statement of changes in equity tracks total equity over time. This information ties back to a balance sheet for the same period; the ending balance on the change of equity statement equals the total equity reported on the balance sheet.

The formula for changes to shareholder equity will vary from company to company; in general, there are a couple of components:

- Beginning equity : This is the equity at the end of the last period that simply rolls to the start of the next period.

- (+) Net income : This is the amount of income the company earned in a given period. The proceeds from operations are automatically recognized as equity in the company, and this income is rolled into retained earnings at year-end.

- (-) Dividends : This is the amount of money that is paid out to shareholders from profits. Instead of keeping all of a company's profits, the company may choose to give some profits away to investors.

- (+/-) Other comprehensive income : This is the period-over-period change in other comprehensive income. Depending on transactions, this figure may be an addition or subtraction from equity.

In ExxonMobil's statement of changes in equity, the company also records activity for acquisitions, dispositions, amortization of stock-based awards, and other financial activities. This information is useful for analyzing how much money is being retained by the company for future growth as opposed to being distributed externally.

Statement of Comprehensive Income

An often less utilized financial statement, the statement of comprehensive income summarizes standard net income while also incorporating changes in other comprehensive income (OCI). Other comprehensive income includes all unrealized gains and losses that are not reported on the income statement. This financial statement shows a company's total change in income, even gains and losses that have yet to be recorded in accordance with accounting rules.

Examples of transactions that are reported on the statement of comprehensive income include:

- Net income (from the statement of income)

- Unrealized gains or losses from debt securities

- Unrealized gains or losses from derivative instruments

- Unrealized translation adjustments due to foreign currency

- Unrealized gains or losses from retirement programs

In the example below, ExxonMobil has over $2 billion of net unrecognized income. Instead of reporting just $23.5 billion of net income, ExxonMobil reports nearly $26 billion of total income when considering other comprehensive income.

Nonprofit Financial Statements

Nonprofit organizations record financial transactions across a similar set of financial statements. However, due to the differences between a for-profit entity and a purely philanthropic entity, there are differences in the financial statements used. The standard set of financial statements used for a nonprofit entity includes:

- Statement of Financial Position: This is the equivalent of a for-profit entity's balance sheet. The largest difference is nonprofit entities do not have equity positions; any residual balances after all assets have been liquidated and liabilities have been satisfied are called "net assets."

- Statement of Activities: This is the equivalent of a for-profit entity's statement of income. This report tracks the changes in operation over time, including the reporting of donations, grants, event revenue, and expenses to make everything happen.

- Statement of Functional Expenses: This is specific to nonprofit entities. The statement of functional expenses reports expenses by entity function (often broken into administrative, program, or fundraising expenses). This information is distributed to the public to explain what proportion of company-wide expenditures are related directly to the mission.

- Statement of Cash Flow: This is the equivalent of a for-profit entity's statement of cash flow. Though the accounts listed may vary due to the different nature of a nonprofit organization, the statement is still divided into operating, investing, and financing activities.

The purpose of an external auditor is to assess whether an entity's financial statements have been prepared following prevailing accounting rules and whether any material misstatements are impacting the validity of results.

Limitations of Financial Statements

Although financial statements provide a wealth of information on a company, they do have limitations. The statements are often interpreted differently, so investors often draw divergent conclusions about a company's financial performance.

For example, some investors might want stock repurchases , while others might prefer to see that money invested in long-term assets. A company's debt level might be fine for one investor, while another might have concerns about the level of debt for the company.

When analyzing financial statements , it's important to compare multiple periods to determine any trends and compare the company's results to its peers in the same industry.

Lastly, financial statements are only as reliable as the information fed into the reports. Too often, it's been documented that fraudulent financial activity or poor control oversight have led to misstated financial statements intended to mislead users. Even when analyzing audited financial statements, there is a level of trust that users must place in the validity of the report and the figures being shown.

What Are the Main Types of Financial Statements?

The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement. These three statements together show the assets and liabilities of a business, its revenues, and costs, as well as its cash flows from operating, investing, and financing activities.

What Are the Benefits of Financial Statements?

Financial statements show how a business operates. It provides insight into how much and how a business generates revenues, what the cost of doing business is, how efficiently it manages its cash, and what its assets and liabilities are. Financial statements provide all the details on how well or poorly a company manages itself.

How Do You Read Financial Statements?

Financial statements are read in several different ways. First, financial statements can be compared to prior periods to understand changes over time better. Financial statements are also read by comparing the results to competitors or other industry participants. By comparing financial statements to other companies, analysts can get a better sense of which companies are performing the best and which are lagging behind the rest of the industry.

What Is GAAP?

Generally Accepted Accounting Principles (GAAP) are the rules by which publicly-owned United States companies must prepare their financial statements. It is the guideline that explains how to record transactions, when to recognize revenue, and when expenses must be recognized. International companies may use a similar but different set of rules called International Financial Reporting Standards (IFRS).

The Bottom Line

Financial statements are the ticket to the external evaluation of a company's financial performance. The balance sheet reports a company's financial health through its liquidity and solvency, while the income statement reports its profitability. A statement of cash flow ties these two together by tracking sources and uses of cash. Together, these financial statements attempt to provide a more clear picture of a business's financial standing.

U.S. Securities and Exchange Commission. " Exxon Mobile Corporation Form 10-K for the Fiscal Year Ended Dec. 31, 2021 ."

- Valuing a Company: Business Valuation Defined With 6 Methods 1 of 37

- What Is Valuation? 2 of 37

- Valuation Analysis: Meaning, Examples and Use Cases 3 of 37

- Financial Statements: List of Types and How to Read Them 4 of 37

- Balance Sheet: Explanation, Components, and Examples 5 of 37

- Cash Flow Statement: How to Read and Understand It 6 of 37

- 6 Basic Financial Ratios and What They Reveal 7 of 37

- 5 Must-Have Metrics for Value Investors 8 of 37

- Earnings Per Share (EPS): What It Means and How to Calculate It 9 of 37

- P/E Ratio Definition: Price-to-Earnings Ratio Formula and Examples 10 of 37

- Price-to-Book (PB) Ratio: Meaning, Formula, and Example 11 of 37

- Price/Earnings-to-Growth (PEG) Ratio: What It Is and the Formula 12 of 37

- Fundamental Analysis: Principles, Types, and How to Use It 13 of 37

- Absolute Value: Definition, Calculation Methods, Example 14 of 37

- Relative Valuation Model: Definition, Steps, and Types of Models 15 of 37

- Intrinsic Value of a Stock: What It Is and Formulas to Calculate It 16 of 37

- Intrinsic Value vs. Current Market Value: What's the Difference? 17 of 37

- The Comparables Approach to Equity Valuation 18 of 37

- The 4 Basic Elements of Stock Value 19 of 37

- How to Become Your Own Stock Analyst 20 of 37

- Due Diligence in 10 Easy Steps 21 of 37

- Determining the Value of a Preferred Stock 22 of 37

- Qualitative Analysis 23 of 37

- How to Choose the Best Stock Valuation Method 24 of 37

- Bottom-Up Investing: Definition, Example, Vs. Top-Down 25 of 37

- Financial Ratio Analysis: Definition, Types, Examples, and How to Use 26 of 37

- What Book Value Means to Investors 27 of 37

- Liquidation Value: Definition, What's Excluded, and Example 28 of 37

- Market Capitalization: What It Means for Investors 29 of 37

- Discounted Cash Flow (DCF) Explained With Formula and Examples 30 of 37

- Enterprise Value (EV) Formula and What It Means 31 of 37

- How to Use Enterprise Value to Compare Companies 32 of 37

- How to Analyze Corporate Profit Margins 33 of 37

- Return on Equity (ROE) Calculation and What It Means 34 of 37

- Decoding DuPont Analysis 35 of 37

- How to Value Private Companies 36 of 37

- Valuing Startup Ventures 37 of 37

:max_bytes(150000):strip_icc():format(webp)/Understanding-the-Cash-Flow-Statement-Color-fc25b41daf7d45e3a63fd5f916fbf9ee.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Virtual Lab School

Installation staff login.

- Reset your password

CDA Competency Statement V

Statistics Made Easy

Excel: How to Use an IF Function with 5 Conditions

You can use the following formulas to create an IF function with 5 conditions in Excel:

Method 1: Nested IF Function

Method 2: IF Function with AND Logic

Method 3: IF Function with OR Logic

The following examples show how to use each formula in practice with the following dataset in Excel:

Example 1: Nested IF Function

We can type the following formula into cell F2 to return a ranking tier value of A through F based on the value for each player in the Points column:

We can then drag and fill this formula down to each remaining cell in column E:

Here’s what this formula did:

- If the value in the Points column is less than 15, return F .

- Else, if the value in the Points column is less than 20, return E .

- Else, if the value in the Points column is less than 25, return D .

- Else, if the value in the Points column is less than 30, return C .

- Else, if the value in the Points column is less than 35, return B .

- Else, return A .

Example 2: IF Function with AND Logic

We can type the following formula into cell F2 to return “Yes” if five conditions are met for a specific player or “No” if at least one of the conditions is not met:

- If the value in the Team column was “Mavs” and the value in the Position column was “Guard” and the value in the Points column was greater than 20 and the value in the Assists column was greater than 4 and the value in the Steals column was greater than 2, return Yes .

- Else, if at least one condition is not met then return No .

Example 3: IF Function with OR Logic

We can type the following formula into cell F2 to return “Yes” if at least one of five conditions are met for a specific player or “No” if none of the conditions are met:

- If the value in the Team column was “Mavs” or the value in the Position column was “Guard” or the value in the Points column was greater than 20 or the value in the Assists column was greater than 4 or the value in the Steals column was greater than 2, return Yes .

- Else, if none of the conditions are met then return No .

Additional Resources

The following tutorials explain how to perform other common tasks in Excel:

Excel: How to Use COUNTIF with Multiple Ranges Excel: A Simple Formula for “If Not Empty” Excel: How to Use a RANK IF Formula

Featured Posts

Hey there. My name is Zach Bobbitt. I have a Masters of Science degree in Applied Statistics and I’ve worked on machine learning algorithms for professional businesses in both healthcare and retail. I’m passionate about statistics, machine learning, and data visualization and I created Statology to be a resource for both students and teachers alike. My goal with this site is to help you learn statistics through using simple terms, plenty of real-world examples, and helpful illustrations.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Join the Statology Community

Sign up to receive Statology's exclusive study resource: 100 practice problems with step-by-step solutions. Plus, get our latest insights, tutorials, and data analysis tips straight to your inbox!

By subscribing you accept Statology's Privacy Policy.

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

Margin Size

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

5.1: Logic Statements

- Last updated

- Save as PDF

- Page ID 113157

- David Lippman

- Pierce College via The OpenTextBookStore

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

Learning Objectives

- Identify a logical statement

- Construct the negation of a statement, including the use of quantifiers

- Construct a compound statement using conjunctions and disjunctions

Logic is the study of the methods and principles of reasoning. In logic, statement is a declarative sentence that is either true or false, but not both. The key to constructing a good logical statement is that there must be no ambiguity. To be a statement, a sentence must be true or false. It cannot be both. In logic, the truth of a statement is established beyond ANY doubt by a well-reasoned argument.

So, a sentence such as "The house is beautiful" is not a statement, since whether the sentence is true or not is a matter of opinion.

A question such as "Is it snowing?" is not a statement, because it is a question and is not declaring that something is true.

Some sentences that are mathematical in nature often are not statements because we may not know precisely what a variable represents. For example, the equation \( 3x + 5 = 10\) is not a statement, since we do not know what \(x \) represents. If we substitute a specific value for \( x\) (such as \(x = 4\)), then the resulting equation, \( 3x + 5 = 10\) is a statement (which is a false statement).

A statement is a sentence that is either true or false.

In logic, lower case letters are often used to represent statements such as \(p\), \(q\) or \(r\).

Example \(\PageIndex{1}\)

The following are statements:

- Zero times any real number is zero.

- \(1+1 = 2.\)

- All birds can fly. (This is a false statement. How can you establish that?)

The following are not statements:

- Who are you?

- I am lying right now. (This is a paradox. If I'm lying I'm telling the truth and if I'm telling the truth I'm lying.)

Try It \(\PageIndex{1}\)

Which of the following are statements?

- I like sports cars.

- \( 2+3=6\).

- Where are you?

Only b is correct since you cannot determine if a is true, and c is a question that is neither true nor false.

The negation of a statement is a statement that has the opposite truth value of the original statement.

Notation: \(\sim p\) (read: "the negation of \(p\)" or "not \(p\)")

The negation of a true statement must be a false statement and vice-versa. A simple statement can often be negated by adding or removing the word "not." A statement can also be negated by adding "It is not true that ... (statement)" or "It is not the case that ... (statement)."

Example \(\PageIndex{2}\)

Find the negation of the following statements:

- \(p\): The car is red.

- \(q\): Homework is not due today.

- \(\sim p\): The car is not red. Note that \(p\) is true and \(\sim p\) is false.

- \(\sim q\): Homework is due today. Note that \(q\) and \(\sim q\) have opposite truth values. If \(q\) is true, then \(\sim q\) is false, or if \(q\) is false, then \(\sim q\) is true.

Logical statements are related to sets and set operations. Words that describe an entire set, such as “all”, “every”, or “none”, are called universal quantifiers because that set could be considered a universal set. In contrast, words or phrases such as “some”, “one”, or “at least one” are called existential quantifiers because they describe the existence of at least one element in a set.

Quantifiers

A universal quantifier states that an entire set of things share a characteristic.

An existential quantifier states that a set contains at least one element.

Something interesting happens when we negate a quantified statement. When we negate a statement with a universal quantifier, we get a statement with an existential quantifier, and vice-versa.

Negating a quantified statment

In logic, when you have a statement and a negation, one must be negative, meaning it contains "no" or "not", and the other must be positive. For example, for the statement "All students love math," the negation cannot be "Some students love math" since neither statement is negative, even though they appear to have opposite truth values. "Some students love math" could include the case that "All students love math". The correct negation is "Some students do not love math".

Example \(\PageIndex{3}\)

Write the negation of “Somebody brought a flashlight.”

Since the statement is of the form "Some A are B ," the negation will be of the form "No A are B ." The negation is “Nobody brought a flashlight.”

Example \(\PageIndex{4}\)

Write the negation of “There are no prime numbers that are even.”

Since the statement is of the form "No A are B ," the negation will be of the form "At least one A is B ." The negation is “At least one prime number is even.”

Try It \(\PageIndex{2}\)

Write the negation of “All Icelandic children learn English in school.”

Some Icelandic children do not learn English in school.

We can make a new statement from other statements; we call these compound statements . Compound statements are formed by connecting 2 or more simple statements with operators such as and and or .

The symbol \(\wedge\) is a conjunction and is used for "and": \( p\) and \(q\) is notated \(p \wedge q\)

The symbol \(\vee\) is a disjunction and is used for "or" (here "or" is not exclusive): \(p\) or \(q\) is notated \(p \vee q\)

You can remember the first two symbols by relating them to the shapes for the union and intersection. \(p \wedge q\) would be the elements that exist in both sets, in \(p \cap q\). Likewise, \(p \vee q\) would be the elements that exist in either set, in \(p \cup q\). When we are working with sets, we use the rounded version of the symbols; when we are working with statements, we use the pointy version.

Example \(\PageIndex{5}\)

Translate each statement into symbolic notation. Let \(p\) represent "I like Pepsi" and let \(c\) represent "I like Coke".

- I like Pepsi or I like Coke.

- I like Pepsi and I like Coke.

- I do not like Pepsi.

- It is not the case that I like Pepsi or Coke.

- I like Pepsi but I do not like Coke.

- \(p \vee c\)

- \(p \wedge c\)

- \(\sim(p \vee c)\)

- \(p \ \wedge \sim c\)

As you can see, we can use parentheses to organize more complicated statements.

Try It \(\PageIndex{3}\)

Translate “We have carrots or we will not make soup” into symbols. Let \(c\) represent “we have carrots” and let \(s\) represent “we will make soup”.

\(c \ \vee \sim s\)

5 Types of Financial Statements (The Completed Set and Beginner Guide)

Financial statements are reports or statements that provide the details of the entity’s financial information, including assets, liabilities, equities, incomes and expenses, shareholders’ contributions, cash flow, and other related information during the period of time.

These statements normally require an annual audit by independent auditors and are presented along with other information in the entity’s annual report.

They are presented in two comparison periods to understand the current period’s financial performance compared to the corresponding period so that users can see how the entity financially performs.

Based on IAS 1, there are five types of Financial Statements that the entity must prepare and present if those statements are prepared by using IFRS , and the same as if they are using US GAAP.

Most local GAAP also required the same thing. The statements must be prepared and presented in a true and fair view concerning the acceptable financial reporting framework and the law.

Financial statements are used by different stakeholders, including the entity’s management, shareholders, investors, staff, major customers, major suppliers, government authorities, stock exchanges, and other related stakeholders.

In general, there are five types of financial statements the income statement , statement of financial position , statement of change in equity, cash flow statement, and the Noted (disclosure) to financial statements. that is prepared by an entity monthly, quarterly, annually, or for the period required by management.

In this article, we will discuss all of those completed set financial statements.

Five Types of Financial Statements:

1) income statement:.

The income statement is one of the financial statements of an entity that reports three main financial information of an entity for a specific period. This information included revenues, expenses, and profit or loss for the period.

The income statement is sometimes called the statement of financial performance because this statement lets the users assess and measure the financial performance of an entity from period to period of a similar entity, competitors, or the entity itself.

This statement could be presented in two formats that IFRS allows based on an entity’s decision. The first is a single statement format where both income and other comprehensive statements are present in one statement.

The second format is the multi-statement, where income statements and other comprehensive income are present in two different formats.

In conclusion, if the users want to see how much the entity makes sales, how much the expenses are incurred, and how much the profit or loss is during the period, then the income statement is the statement that the user should be looking for.

The details of these three main pieces of information are as follows:

1.1 Revenues:

Revenues refer to sales of goods or services that the entity generates during the specific accounting period.

The revenues present in the income statements are the revenues generated from both cash sales and credit sales. In the revenues section, you could know how much the entity makes net sales for their covering period.

Revenues are normally reported as the summary in the income statement. If you want to check the details, you probably need to check with the revenues provided in the financial report.

In Noted, users may see the different revenue lines that the entity is generating for the period. This could help users to understand which line of revenues is significantly increasing or declining.

In double entries accounting, revenues are increasing on credit and decreasing on debit. It only recognizes when there is a probability of economic inflow to the entity due to the sale of goods or services. And the risks and rewards of sales are transferred.

1.2 Expenses:

Expenses are operational costs that occur in the entity for a specific accounting period. They rank from operating expenses like salary expenses, utilities, depreciation, transportation, and training expenses to tax expenses and interest expenses.

Expenses here also include the costs of goods sold or the cost of rendering services that are incurred during the period.

Yet, they normally report the different line between the cost of goods sold and general and administrative expenses.

In the income statement, expenses could be presented based on their nature or based on their function.

Expenses are recorded in a different direction from revenues in terms of the accounting entry. They are increasing in debit and increase in credit.

1.3 Profit or Loss:

Profit or loss refers to net income or the income statement’s bottom line that results from deducting expenses from revenues.

If the revenues during the period are higher than expenses, then there is profit.

However, if the expenses are higher than revenues, then there will be losses.

Profit or loss for the period will be forwarded to retain profit or loss in the balance sheet and statement of change in equity.

2) Balance Sheet:

A Balance Sheet is sometimes called a statement of financial position. It shows the balance of assets, liabilities, and equity at the end of the period.

The balance sheet is sometimes called the statement of financial position since it shows the values of the entity’s net worth. You can find an entity’s net worth by removing liabilities from total assets.

It is different from the income statement since the balance sheet reports the account’s balance at the reporting date. In contrast, the income statement reports the account’s transactions during the reporting period.

If the user of financial statements wants to know the entity’s financial position, then the balance sheet is the statement the user should be looking for.

2.1 Assets:

Assets are resources owned by an entity legally and economically. For example, buildings, land, cars, and money are types of assets of the entity. Assets are classified into two main categories: Current Assets and Noncurrent Assets.

Current Assets refer to short-term assets, including cash on hand, petty cash, raw materials, work in progress, finished goods, prepayments, and similar kinds that convert and are consumed within 12 months from the reporting date.

Non-current assets, including tangible and intangible assets, are expected to convert and consume more than 12 months from the reporting date. Those assets include land, buildings, machinery, computer equipment, long-term investment, and similar kinds.

Intangible fixed assets are charged into income statements systematically based on their use and contribution.

In the accounting equation, assets are equal to liabilities plus equities. They are increasing debt and decreasing credit.

2.2 Liabilities:

Liabilities are an entity’s obligation to other persons or entities—for example, credit purchases, bank loans, interest payable, taxes payable, and an overdraft.

The same as assets, liabilities are classified into two types: Current Liabilities and Non-current liabilities. The liabilities are the balance sheet items, and they represent the amount at the end of the accounting period.

A current liability is an obligation that is due within one year. In other words, the entity is expected to pay or be willing to pay back the debt within one year.

For example, a purchase on credit within one month should be recorded as a current liability.

Non-current liabilities are debts or obligations that are due for more than one year or more than twelve months.

For example, a long-term lease due in more than twelve months should be recorded in the non-current liability.

2.3 Equity:

Equities are the difference between assets and liabilities. The items in equity include share capital, retained earnings, common stock, preferred stock, and reserves.

The change in assets and liabilities over the period will affect the net value of equity. You can calculate the net value of equity of an entity by removing liabilities from assets.

The net income or loss of the company record in the income statement during the period will be added to the opening balance of retained earnings or accumulated loss.

3) Statement of Change in Equity:

A statement of change inequity is one financial statement that shows the shareholder contribution and movement in equity. And equity balance at the end of the accounting period.

Information that shows these statements includes the classification of share capital, total share capital, retained earnings, dividend payment, and other related state reserves.

Please note that the statement of change of equity results from the income statement and balance sheet .

If the income statement and balance sheet are correctly prepared, the statement of change in equity would be corrected too.

4) Statement of Cash Flow:

The cash flow statement is one of the financial statements that show the movement (cash inflow and outflow) of the entity’s cash during the period. This statement helps users understand how is the cash movement in the entity.

There are three sections in this statement. They are cash flow from the operation, cash flow from investing, and cash flow from financing activities.

For example, cash flow from operating activities helps users know how much cash an entity generates from the operation.

The users could also understand the company’s cash flow on investing activities by reviewing the cash movement in the investing activities section. For example, users could the cash movement that the company uses for purchasing PPE.

Also, users want to see the cash movement of the company on investing activities which include the actual funds that the company received and paying off the loan, for example. Other similar investing cavities fund flow is also reported in this section.

In general, the information will be shown based on the cash flow method that the entity prepares. It includes direct and indirect methods.

5) Noted to Financial Statements:

Note to Financial Statements is an important statement that most people forget about.

This is the mandatory requirement by IFRS that the entity has to disclose all information that matters to financial statements and help users better understand.

Note or sometimes call disclosure detail the financial information related to the specific accounts. For example, in the balance sheet, you will see the balance of fixed assets.

However detailed information on those fixed assets is not included in the statement of financial position. If the users want to learn more about those fixed assets, they need to note those fixed assets.

What is the order of financial statements?

Now we already know what financial statements the company needs to prepare for the period to comply with the relevant financial reporting standard.

But, among these statements, which statement needs to be prepared first?

The correct order of financial statements is the income statement, statement of change in equity, statement of financial position, and statement of cash flow.

However, before you can prepare the income statement, you must first have the correct trial balance. Once you have the corrected trial balance, you can start preparing the income statement.

Now, after you finish the income statement, you should be able to draft the statement of change in equity, followed by the balance sheet, and finally, you can draft the statement of cash flow.

Noted to a financial statement is practically drafted in a Word file, and at the time the four financial statements are finalized.

Can non-CPA approve financial statements?

Yes, financial statements could be approved by non-CPAs and it is normally approved by the Board of Directors after endorsing by the audit committee. The date of approval should be before or the same date as the auditor’s opinion date.

What Type of Financial Statements Forecast Company Trends?

When forecasting company trends, several types of financial statements play a crucial role.

These statements provide valuable insights into a company’s financial performance and can help predict future trends.

Let’s explore the main types of financial statements used for this purpose:

- Income statement: The income statement outlines a company’s revenues and expenses over a specific period. By analyzing this statement, you can observe how a company’s profits have evolved and identify the key drivers behind these changes. It offers a comprehensive view of the company’s financial performance.

- Balance sheet: The balance sheet presents a snapshot of a company’s assets, liabilities, and equity at a particular point in time. By examining the balance sheet, you can track changes in the company’s financial position over time and identify the factors contributing to these fluctuations. It provides valuable insights into a company’s liquidity, leverage, and financial health.

- Cash flow statement: The cash flow statement highlights the sources and uses of cash by a company over a given period. By studying this statement, you can understand how a company generates and utilizes cash and identify the key drivers behind these cash flow changes. It helps assess a company’s ability to meet its financial obligations and invest in growth opportunities.

Alongside these primary financial statements, additional financial metrics aid in forecasting company trends.

Some of these metrics include:

- Sales growth: This metric reveals how a company’s sales have evolved, reflecting its market performance and customer demand.

- Profit margin: The profit margin showcases a company’s profitability by indicating the portion of sales revenue that translates into profit.

- The debt-to-equity ratio compares a company’s debt to its equity and helps assess its financial leverage and solvency.

- Return on equity: This metric measures the profitability generated by a company for its shareholders, indicating its efficiency in utilizing invested capital.

To effectively forecast company trends using financial statements, consider the following tips:

- Leverage historical data: Analyze how the company’s financial statements have changed to identify patterns and trends that may indicate future performance.

- Account for the economic environment: Recognize that broader economic conditions can significantly impact a company’s financial performance and incorporate this understanding into your forecasts.

- Adjust for seasonality: If a company’s business experiences seasonal variations, adjust appropriately to account for these patterns when forecasting its financial performance.

- Employ multiple forecasting methods: Utilize various techniques to enhance accuracy and gain a more comprehensive understanding of potential trends.

- Monitor and refine forecasts: Continuously track your forecasts and adjust as new information becomes available, ensuring that your predictions remain up-to-date and relevant.

By diligently analyzing financial statements, considering relevant metrics, and implementing effective forecasting practices, you can gain valuable insights into a company’s trajectory and make informed decisions about investment opportunities.

Written by Sinra

Related Posts

3 main purposes of financial statements (explained), what is asset definition, explanation, types, classification, formula, and measurement, 5 main elements of financial statements: assets, liabilities, equity, revenues, expenses, income statement: definition, types, templates, examples, and more.

- Online and Mobile Banking

- Paperless Statements and eStatements

Paperless. It's the smart way to go.

Save time and cut the clutter with online statements.

Set up your online statements

Securely view your statements online, anytime.

Why wait to get your statements in the mail? You can see your online statements as soon as they're ready through mobile or online banking! It's the fast, safe and easy way to stay on top of your account statements.

With online statements, you can :

- Access up to 24 months of account statements

- Get alerts when your statements are ready for viewing

- Stay organized with all your statements in one place

Go paperless. Get started today

Mobile Banking

- Log into the mobile app and tap the Profile icon in top left corner.

- Click on "Enrollments."

- Choose "Paperless Statements."

- Choose which documents you would like to be delivered by checking the boxes next to each statement.

- Click "Save Changes."

Online Banking

- Log in now: Go Paperless

- That will take you directly to the Paperless Preferences page.

- Then, select the documents you want to receive electronically.

Related Services

- Online Bill Pay

Additional Resources

How Much Should You Keep in Checking vs. Savings?

It's important to understand the difference between your checking and savings accounts. Here are the differences and the best way to utilize both.

A hassle-free banking app to pay virtually anyone: Zelle

With your mobile device, sending and receiving continues to get easier with the Fifth Third Bank line of banking services.

Understanding the Benefits of Robo Advisors

Do you want to launch a valuable investment portfolio? Read how robo advisors can help manage and automate your investments at Fifth Third Bank.

Leaving 53.com

You are leaving a Fifth Third website and will be going to a website operated by a third party which is not affiliated with Fifth Third Bank. That site has a privacy policy and security practices that are different from that of the Fifth Third website. Fifth Third and its affiliates are not responsible for the content on third parties.

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

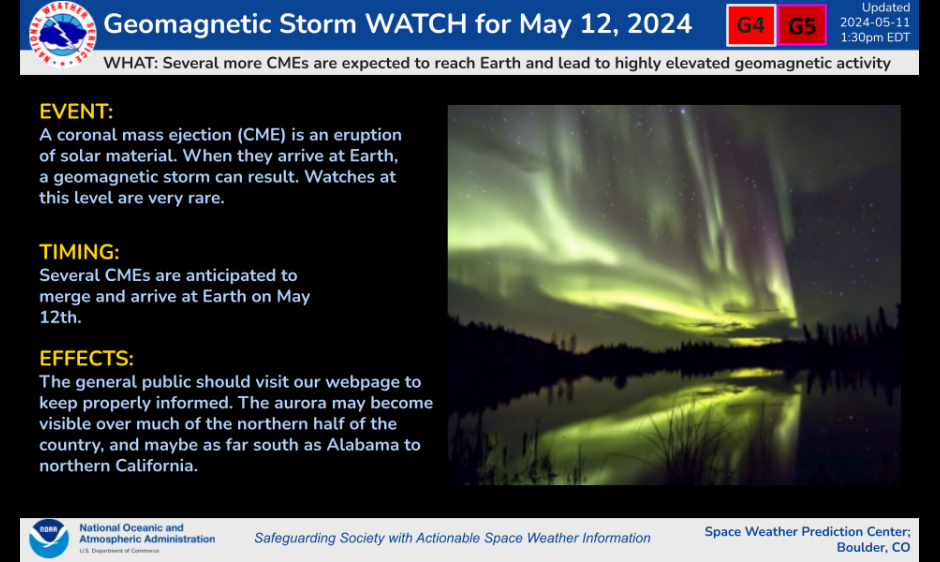

Strong geomagnetic storm reaches Earth, continues through weekend

NOAA space weather forecasters have observed at least seven coronal mass ejections (CMEs) from the sun, with impacts expected to arrive on Earth as early as midday Friday, May 10, and persist through Sunday, May 12, 2024.

NOAA’s Space Weather Prediction Center (SWPC) has issued a Geomagnetic Storm Warning for Friday, May 10. Additional solar eruptions could cause geomagnetic storm conditions to persist through the weekend.

- The First of Several CMEs reached Earth on Friday, May 10 at 12:37 pm EDT. The CME was very strong and SWPC quickly issued a series of geomagnetic storm warnings. SWPC observed G4 conditions at 1:39 pm EDT (G3 at 1:08 pm EDT).

- This storm is ongoing and SWPC will continue to monitor the situation and provide additional warnings as necessary.

This is an unusual and potentially historic event. Clinton Wallace , Director, NOAA’s Space Weather Prediction Center

CMEs are explosions of plasma and magnetic fields from the sun’s corona. They cause geomagnetic storms when they are directed at Earth. Geomagnetic storms can impact infrastructure in near-Earth orbit and on Earth’s surface , potentially disrupting communications, the electric power grid, navigation, radio and satellite operations. SWPC has notified the operators of these systems so they can take protective action.

Geomagnetic storms can also trigger spectacular displays of aurora on Earth . A severe geomagnetic storm includes the potential for aurora to be seen as far south as Alabama and Northern California.

Related Features //

Organizations

Space Weather Prediction Center

National Oceanic and Atmospheric Administration

- Earth's Climate

- Electric Power Transmission

- GPS Systems

- HF Radio Communications

- Satellite Communications

- Satellite Drag

- Commercial Service Providers

- Federal Agencies

- International Organizations

- International Service Providers

- Space Weather Research

- Coronal Holes

- Coronal Mass Ejections

- Earth's Magnetosphere

- F10.7 cm Radio Emissions

- Galactic Cosmic Rays

- Geomagnetic Storms

- Ionospheric Scintillation

- Radiation Belts

- Solar EUV Irradiance

- Solar Flares (Radio Blackouts)

- Solar Radiation Storm

- Sunspots/Solar Cycle

- Total Electron Content

- NOAA Space Weather Scales

- Customer Needs & Requirements Study

- 27-Day Outlook of 10.7 cm Radio Flux and Geomagnetic Indices

- 3-Day Forecast

- 3-Day Geomagnetic Forecast

- Forecast Discussion

- Predicted Sunspot Numbers and Radio Flux

- Report and Forecast of Solar and Geophysical Activity

- Solar Cycle Progression

- Space Weather Advisory Outlook

- USAF 45-Day Ap and F10.7cm Flux Forecast

- Weekly Highlights and 27-Day Forecast

- Forecast Verification

- Geoalert - Alerts, Analysis and Forecast Codes

- Geophysical Alert

- Solar and Geophysical Event Reports

- USAF Magnetometer Analysis Report

- Aurora - 30 Minute Forecast

- CTIPe Total Electron Content Forecast

- D Region Absorption Predictions (D-RAP)

- Geoelectric Field Models (US Canada 1D & 3D EMTF CONUS)

- Geospace Geomagnetic Activity Plot

- Geospace Ground Magnetic Perturbation Maps

- Geospace Magnetosphere Movies

- North American (US Region) Total Electron Content

- North American Total Electron Content

- Relativistic Electron Forecast Model

- STORM Time Empirical Ionospheric Correction

- WSA-Enlil Solar Wind Prediction

- Boulder Magnetometer

- GOES Electron Flux

- GOES Magnetometer

- GOES Proton Flux

- GOES Solar Ultraviolet Imager (SUVI)

- GOES X-ray Flux

- LASCO Coronagraph

- Planetary K-index

- Real Time Solar Wind

- Satellite Environment

- Solar Synoptic Map

- Space Weather Overview

- Station K and A Indices

- Solar & Geophysical Activity Summary

- Solar Region Summary

- Summary of Space Weather Observations

- Alerts, Watches and Warnings

- Notifications Timeline

- ACE Real-Time Solar Wind

- Aurora Viewline for Tonight and Tomorrow Night

- Electric Power Community Dashboard

- International Civil Aviation Organization (ICAO) Space Weather Advisory

- Solar TErrestrial RElations Observatory (STEREO)

- Data Access

- Electric Power

- Emergency Management

- Global Positioning System

- Space Weather Enthusiasts

- Education and Outreach

- News Archive

- Annual Meeting

Severe and Extreme (G4-G5) Geomagnetic Storms Likely on 12 May 2024

Search form, noaa scales mini.

Another series of CMEs associated with flare activity from Region 3664 over the past several days are expected to merge and arrive at Earth by midday (UTC) on 12 May. Periods of G4-G5 (Severe-Extreme) geomagnetic storms are likely to follow the arrival of these CMEs.

Mobile Menu Overlay

The White House 1600 Pennsylvania Ave NW Washington, DC 20500

Order Regarding the Acquisition of Certain Real Property of Cheyenne Leads by MineOne Cloud Computing Investment I L.P.

By the authority vested in me as President by the Constitution and the laws of the United States of America, including section 721 of the Defense Production Act of 1950, as amended (section 721), 50 U.S.C. 4565, it is hereby ordered as follows: Section 1. Findings. I hereby make the following findings: (a) There is credible evidence that leads me to believe that (1) MineOne Partners Limited, a British Virgin Islands company ultimately majority owned by Chinese nationals (“MineOne Partners”); (2) MineOne Cloud Computing Investment I L.P., a British Virgin Islands limited partnership (“MineOne Cloud”); (3) MineOne Data Center LLC, a Delaware limited liability company (“MineOne Data”); and (4) MineOne Wyoming Data Center LLC, a Delaware limited liability company (“MineOne Wyoming” and together with MineOne Partners, MineOne Cloud, MineOne Data, and MineOne Wyoming, the “Purchasers”), through the acquisition of certain real estate that is located within 1 mile of Francis E. Warren Air Force Base (“Warren AFB”) (specifically, the 12.06 acres described as Lot 1, Block 10 North Range Business Park 3rd Filing, located at 635 Logistics Drive, Cheyenne, Wyoming, 82009) (the “Real Estate” and such acquisition the “Transaction”), might take action that threatens to impair the national security of the United States; (b) MineOne acquired the Real Estate in June 2022 and then made improvements to allow for use of the Real Estate for specialized cryptocurrency mining operations in close proximity to Warren AFB, a strategic missile base and home to Minuteman III intercontinental ballistic missiles; (c) The Transaction was not filed with the Committee on Foreign Investment in the United States (CFIUS) until after CFIUS’s non-notified transaction team investigated the Transaction as a result of a public tip; (d) CFIUS identified national security risks arising from the Transaction relating to the proximity of the Real Estate to Warren AFB, as well as related risk associated with the presence of specialized equipment on the Real Estate used to conduct cryptocurrency mining operations, some of which is foreign-sourced and presents national security concerns; (e) The proximity of the foreign-owned Real Estate to a strategic missile base and key element of America’s nuclear triad, and the presence of specialized and foreign-sourced equipment potentially capable of facilitating surveillance and espionage activities, presents a national security risk to the United States; (f) Section 721 authorizes CFIUS to negotiate and enter into an agreement or take certain other actions to mitigate the national security risk arising from a covered transaction. Section 721 also requires that such an agreement be effective and verifiable and enable effective monitoring and enforcement to resolve the national security concerns posed by a transaction. After consideration, CFIUS determined it would not be possible to enter into a negotiated agreement that would satisfy those requirements; and (g) Provisions of law, other than section 721 and the International Emergency Economic Powers Act (50 U.S.C. 1701 et seq .), do not, in my judgment, provide adequate and appropriate authority for me to protect the national security in this matter. Sec. 2. Actions Ordered and Authorized. On the basis of the findings set forth in section 1 of this order, considering the factors described in subsection (f) of section 721, as appropriate, and pursuant to my authority under applicable law, including section 721, I hereby order that: (a) The Transaction is hereby prohibited, and ownership by the Purchasers of any interest in or part of the Real Estate, or maintenance of any property rights in the Real Estate (including but not limited to the rights referred to in 31 C.F.R. 802.233), whether effected directly or indirectly through the Purchasers, through the Purchasers’ foreign person shareholders, partners, or beneficial owners, or through the Purchasers’ subsidiaries or affiliates, including but not limited to Terra Crypto, Inc., a Wyoming corporation; Terra Global Asset Management Holdings, Inc., a Delaware corporation; Terra Global Capital, LLC, a Delaware limited liability company; Global Network of Business Consultants, Inc., a New York corporation; and International Intellectual Capital, LLC, a Delaware limited liability company (such subsidiaries and affiliates collectively “Affiliates”), are also prohibited. (b) To effectuate this order, not later than 120 calendar days after the date of this order, unless such date is extended by CFIUS, subject to such conditions on an extension as CFIUS determines are necessary and appropriate to protect the national security of the United States, the Purchasers and their Affiliates shall sell or transfer all direct and indirect legal and beneficial ownership interests or other rights in the Real Estate, and certify in writing that such Divestment has been completed (the “Divestment”). (c) Not later than 90 calendar days after the date of this order, unless such date is extended by CFIUS, subject to such conditions on an extension as CFIUS determines are necessary and appropriate to protect the national security of the United States, the Purchasers, whether directly or indirectly, shall: (i) remove from the Real Estate all items, structures, or other physical objects or installations of any kind (the “Equipment”) that the Purchasers, their Affiliates, or persons acting on their behalf, have stockpiled, stored, deposited, installed, or affixed (the “Equipment Removal”), and certify in writing that such Equipment Removal has been completed; and (ii) remove from the Real Estate all (A) utility and other improvements on or adjacent and connected to the Real Estate; (B) excavation, repair, or new construction on the Real Estate underground; and (C) repair, improvement, or new construction on the Real Estate above ground (collectively, (A) through (C), the “Improvements”) commenced, continued, or completed by the Purchasers or their Affiliates after the closing of the Transaction (the “Improvements Removal”), and certify in writing that such Improvements Removal has been completed. CFIUS is authorized to require inspection of the Real Estate, at no expense to CFIUS, on terms it deems appropriate to ensure that each of the Equipment Removal and Improvements Removal is complete and verified. (d) Immediately from the date of this order until such time as the Divestment, Equipment Removal, and Improvements Removal have been completed and verified to the satisfaction of CFIUS, the Purchasers shall, and shall ensure that all of their Affiliates, refrain from physical or logical access to the Real Estate, Equipment, or Improvements, unless such access is necessary to effectuate the requirements of subsections (a) through (c) of this section as determined by CFIUS. Not later than 7 calendar days after the date of this order and until such time as the Divestment, Equipment Removal, and Improvements Removal have been completed and verified to the satisfaction of CFIUS, the Purchasers shall, and shall ensure that their Affiliates, put in place and maintain any measures or controls necessary to ensure that the access prohibited under this subsection does not occur. (e) Until the Divestment, Equipment Removal, and Improvements Removal have been completed and verified to the satisfaction of CFIUS, the Purchasers shall not, and shall ensure that their Affiliates do not, dissolve, reorganize, or transfer their ownership of or any other property rights in the Real Estate, or otherwise change their legal structure or relocate or sell any physical, intangible, or financial assets in a manner that would materially impede or prevent the Purchasers or their Affiliates from complying with this order. The Purchasers shall, and shall ensure that their Affiliates, notify CFIUS in writing within 24 hours of becoming aware of any actual or potential event of default or other similar occurrence affecting any party’s rights or obligations under outstanding loans related to the Real Estate, Equipment, or Improvements that could materially impede or prevent the Purchasers or their Affiliates from complying with this order. (f) Immediately upon completion of the Divestment, Equipment Removal, and Improvements Removal, the Purchasers shall certify in writing to CFIUS that all steps necessary to fully and permanently effectuate the requirements of subsections (a) through (d) of this section, including any related conditions CFIUS imposes pursuant to this order, have been completed in accordance with this order. (g) The Purchasers shall not, and shall ensure that their Affiliates do not, complete a sale or transfer of the Real Estate to any third party: (i) until the Purchasers notify CFIUS in writing of the intended buyer or transferee; and (ii) unless 10 business days have passed from the notification in subsection (g)(i) of this section and CFIUS has not issued to the Purchasers an objection to the intended buyer or transferee. Among the factors CFIUS may consider in reviewing the proposed sale or transfer are whether the buyer or transferee is a United States citizen or is owned by United States citizens and has or has had a direct or indirect contractual, financial, familial, employment, or other close and continuous relationship with the Purchasers or their Affiliates, or officers or employees of the Purchasers or their Affiliates. In addition, CFIUS may consider whether the proposed sale or transfer would threaten to impair the national security of the United States or undermine the purpose of this order, and whether the sale effectuates, to CFIUS’s satisfaction and in its discretion, a Divestment consistent with subsection (b) of this section. (h) From the date of this order until the Purchasers provide a certification of the Divestment to CFIUS pursuant to subsection (f) of this section, each Purchaser shall certify to CFIUS on a weekly basis that it is in compliance with this order and shall include a description of efforts to effectuate the Divestment, Equipment Removal, and Improvements Removal along with a timeline for projected completion of remaining actions. (i) Any transaction or other instrument entered into or method employed for the purpose of, or with the effect of, evading or circumventing this order is prohibited. (j) Without limitation on the exercise of authority by any agency under other provisions of law, and until such time each of the Divestment, Equipment Removal, and Improvements Removal are completed and verified to the satisfaction of CFIUS, CFIUS is authorized to implement measures it deems necessary and appropriate to verify and enforce compliance with this order. For purposes of verifying and enforcing compliance with this order, employees of the United States Government as designated by CFIUS shall be permitted access, on reasonable notice to the Purchasers or their Affiliates, as applicable, to all premises and facilities of the Purchasers or their Affiliates, including the Real Estate, located in the United States: (i) to inspect and copy any books, ledgers, accounts, correspondence, memoranda, and other records and documents in the possession or under the control of the Purchasers that concern any matter relating to this order; (ii) to inspect or audit any information systems, networks, hardware, software, data, communications, or property in the possession or under the control of the Purchasers; (iii) to interview officers, employees, or agents of the Purchasers, or any of their respective Affiliates, concerning any matter relating to this order; and (iv) to inspect and verify progress or completion of the requirements of subsection (c)(i) and subsection (c)(ii) of this section regarding the Equipment Removal and Improvements Removal. CFIUS shall conclude its verification procedures within 90 calendar days after the certification of the Divestment is provided to CFIUS pursuant to subsection (e) of this section. (k) Without limitation on the exercise of authority by any agency under other provisions of law, and until such time as the Divestment, Equipment Removal, and Improvements Removal are completed and verified to the satisfaction of CFIUS, CFIUS is further authorized to implement measures it deems necessary and appropriate to mitigate risk to the national security of the United States arising from the Transaction, including measures available to it under section 721 and its implementing regulations, which include the remedies available for violations of any agreement or condition entered into or imposed under subsection (l) of section 721. (l) If any provision of this order, or the application of any provision to any person or circumstances, is held by a court of competent jurisdiction to be invalid, the remainder of this order and the application of its other provisions to any other persons or circumstances shall not be affected thereby. If any provision of this order, or the application of any provision to any person or circumstances, is held by a court of competent jurisdiction to be invalid because of the lack of certain procedural requirements, the relevant executive branch officials shall implement those procedural requirements. (m) The Attorney General is authorized to take any steps necessary to enforce this order. Sec. 3. Reservation. I hereby reserve my authority to issue further orders with respect to the Transaction or Purchasers as shall in my judgment be necessary to protect the national security of the United States. Sec. 4. Publication and Transmittal. (a) This order shall be published in the Federal Register . (b) I hereby direct the Secretary of the Treasury to transmit a copy of this order to the appropriate parties named in section 1 of this order. JOSEPH R. BIDEN JR. THE WHITE HOUSE, May 13, 2024.

Stay Connected

We'll be in touch with the latest information on how President Biden and his administration are working for the American people, as well as ways you can get involved and help our country build back better.

Opt in to send and receive text messages from President Biden.

IMAGES

VIDEO

COMMENTS

Summary. This Statement establishes standards of financial accounting and reporting for loss contingencies. It requires accrual by a charge to income (and disclosure) for an estimated loss from a loss contingency if two conditions are met: (a) information available prior to issuance of the financial statements indicates that it is probable that ...

The definition amends the stated definition of a liability in SFFAS Number 1. This Statement establishes accounting for liabilities not covered in SFFAS No. 1 and 2. Statement Number 1 addresses only those selected liabilities that routinely recur in normal operations and are due within a fiscal year.

concepts statement no. 5—recognition and measurement in financial statements of business enterprises (as amended 12/2021)

This Statement establishes standards of financial accounting and reporting for loss contingencies (see paragraphs 8-16) and carries forward without reconsideration the conclusions of Accounting Research Bulletin (ARB) No. 50, "Contingencies," with respect to gain contingencies (see paragraph 17) and other disclosures (see paragraphs 18-19).

Amendments to Statement of Financial Accounting Concepts No. 8—Conceptual Framework for Financial Reporting—Chapter 3, Qualitative Characteristics of Useful Financial Information. (Issue Date 08/2018) Concepts Statement No. 8. Conceptual Framework for Financial Reporting—Chapter 4, Elements of Financial Statements. (Issue Date 12/2021 ...

Business Acquisitions — SEC Reporting Considerations Business Combinations Carve-Out Financial Statements Comparing IFRS Accounting Standards and U.S. GAAP Consolidation — Identifying a Controlling Financial Interest Contingencies, Loss Recoveries, and Guarantees Contracts on an Entity's Own Equity Convertible Debt (Before Adoption of ASU ...

1 FASB Statement of Financial Accounting Concepts No. 6, Elements of Financial Statements (CON 6), states: Probable is used with its usual general meaning, rather than in a specific accounting or technical sense (such as that in FASB Statement 5, Accounting for Contingencies, par. 3), and refers to that which can

Financial statements for businesses usually include income statements , balance sheets , statements of retained earnings and cash flows . It is standard practice for businesses to present ...

Page Not Found or Unavailable! We have recently updated our website publishing platform, resulting in a change to many URLs. For your convenience, please find a list of commonly searched topics with links to their location in the new platform.

Concepts Statement No. 5. Service Efforts and Accomplishments Reporting—an amendment of GASB Concepts Statement No. 2 (Issued 11/08) SUMMARY. This summary provides highlights of the changes to Concepts Statement No. 2, Service Efforts and Accomplishments Reporting. The Board has amended Concepts Statement 2 to reflect developments that have occurred since it was issued in 1994.

5. The auditor should use the same suitable, recognized control framework to perform his or her audit of internal control over financial reporting as management uses for its annual evaluation of the effectiveness of the company's internal control over financial reporting. 7/.

CDA Competency Statement V. Directions: Prepare a reflective statement about how you ensure a well-run, purposeful program that is responsive to participant needs. This statement should be no more than 500 words. Complete Competency Statement V by reflecting on the following questions: How do you use observation, documentation, assessment, and ...

This statement will substantiate the traveler's entitlement at a rate of per diem based upon nonavailability and/or nonutilization of the facilities as indicated in the "Quarters" and "Mess" items on the front of this form. For officers only, this statement will be used for nonavailability of officers' open mess when Government quarters are ...

Statement 5.W.1. •Write opinion pieces on topics or texts, supporting a point of view with reasons and information. a. Introduce a topic or text clearly, state an opinion, and create an organizational structure in which ideas are logically grouped to support the writer's purpose. b. Provide logically ordered reasons that are supported

5 MIT Statistics Courses That Are Free April 18, 2024; Statology Study. Statology Study is the ultimate online statistics study guide that helps you study and practice all of the core concepts taught in any elementary statistics course and makes your life so much easier as a student.

Competency Statement 5. The statement should be no more than 500 words in length. Begin with a paragraph describing how your teaching practices meet the Competency Standard V: To ensure a well-run, purposeful program that is responsive to participant needs. (Note: alternatively, you may also choose to write one paragraph for each Functional ...

is not a statement, because it is a question and is not declaring that something is true. Some sentences that are mathematical in nature often are not statements because we may not know precisely what a variable represents. For example, the equation \( 3x + 5 = 10\) is not a statement, since we do not know what \(x \) represents.

393. Evaluate [3 (5 + 6) + 2]÷7. 5. Select the property that allows the statement 5 = b to be written as b = 5. symmetric. Select the property that allows the statement (a + b) + c to be written as c + (a + b). commutative - addition. Select the property that allows m + 0 to be written as m. identity - addition.

5) Noted to Financial Statements: Note to Financial Statements is an important statement that most people forget about. This is the mandatory requirement by IFRS that the entity has to disclose all information that matters to financial statements and help users better understand.

The P5 churns out 325-Watts across all five of its channels into eight Ohms and 500-Watts per channel into four. It offers both balanced and unbalanced connection options and features not one, but ...

Mobile Banking. Log into the mobile app and tap the Profile icon in top left corner. Click on "Enrollments." Choose "Paperless Statements." Choose which documents you would like to be delivered by checking the boxes next to each statement. Click "Save Changes."

A 5 Year Projected Income Statement is a financial document that forecasts a company's revenue and expenses over the next five years. It helps investors and management assess future profitability and plan strategically. Understanding a five-year projected income statement is crucial for business owners, investors, and financial analysts.

CMEs are explosions of plasma and magnetic fields from the sun's corona. They cause geomagnetic storms when they are directed at Earth. Geomagnetic storms can impact infrastructure in near-Earth orbit and on Earth's surface, potentially disrupting communications, the electric power grid, navigation, radio and satellite operations.SWPC has notified the operators of these systems so they can ...

Competency Statement V To ensure a well-run, purposeful program that is responsive to participant needs. I manage an effective program by ensuring my classroom meets the needs of all the children enrolled. I measure each child's progress on a milestone tracker for their age group. My lesson plans support the milestones the children in my ...