Checkmatter

CHECKMATTER.COM is a blog relating to check/cheque. We inform on check writing & cashing a check on a simple, unbiased and easy to understand manner.

How to write a check for 80 dollars – Check Matter

If you are searching for how to write a check for 80 dollars through your search engine. So you have found the right post.

Welcome to how to write a check for 80 dollars. Everything you need to know about writing an 80 dollars check or what you need to write is discussed in detail below (with pictures). We think that after you read this post, you will understand “how to write a check for 80 dollars” or what you need to write an 80 dollars check. Read on to learn how to fill out a check for 80 dollars.

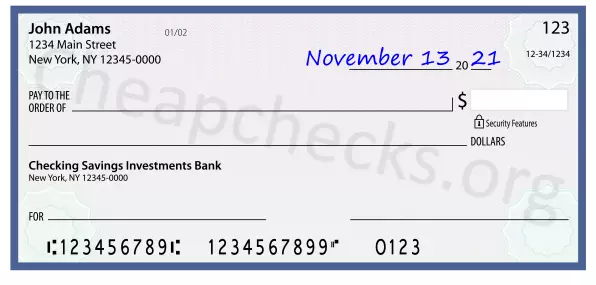

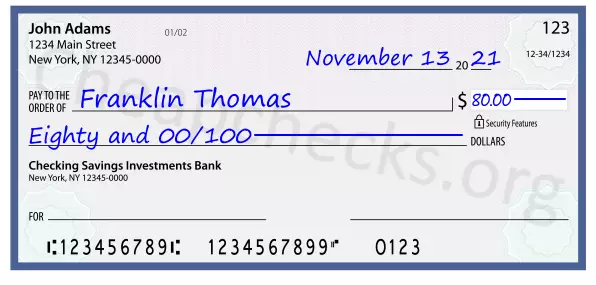

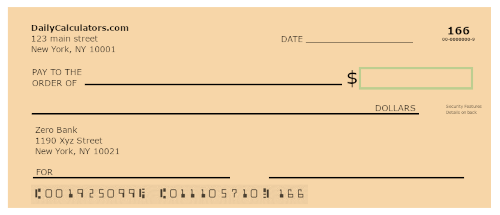

Example of how to fill a check for 80 dollars.

Only 6 steps. Let’s see on the below line…

Step 1: Date Line: At the top right corner of the check on the blank space. Enter the current date.

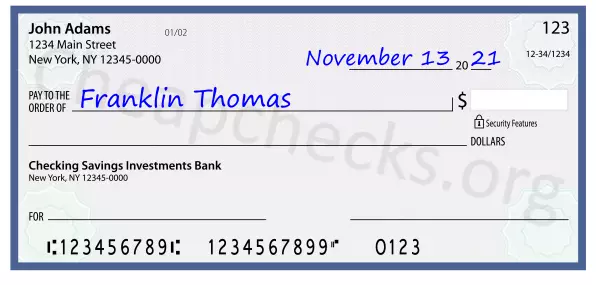

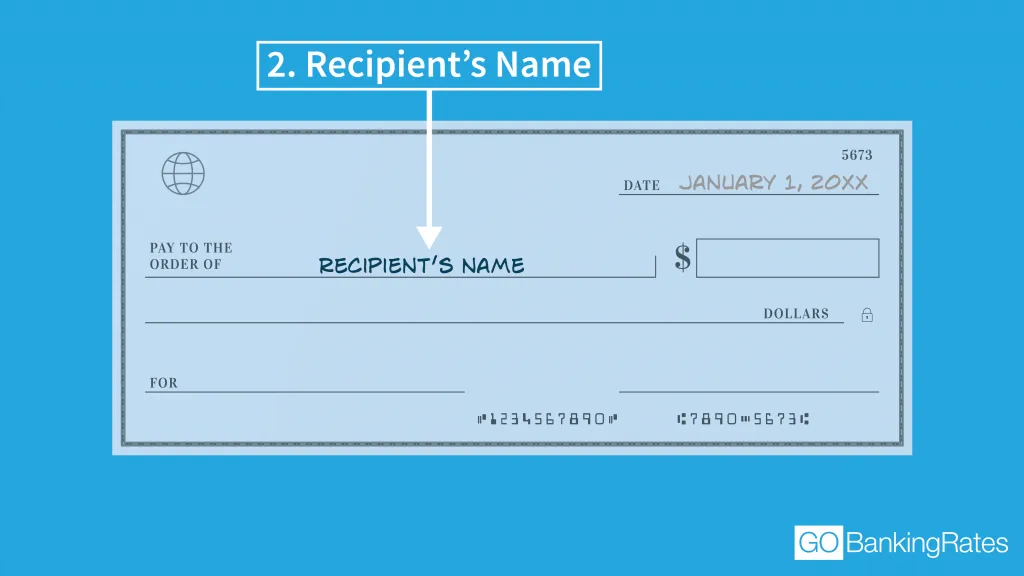

Step 2: Pay Line: In this line, write the name of the person or company you are paying the check.

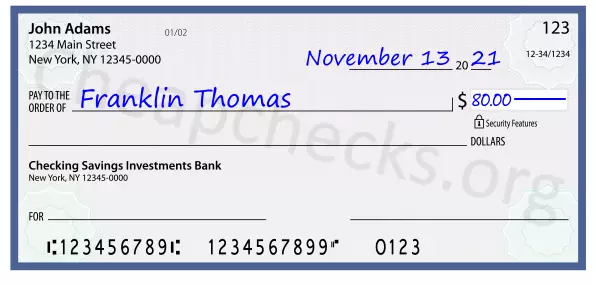

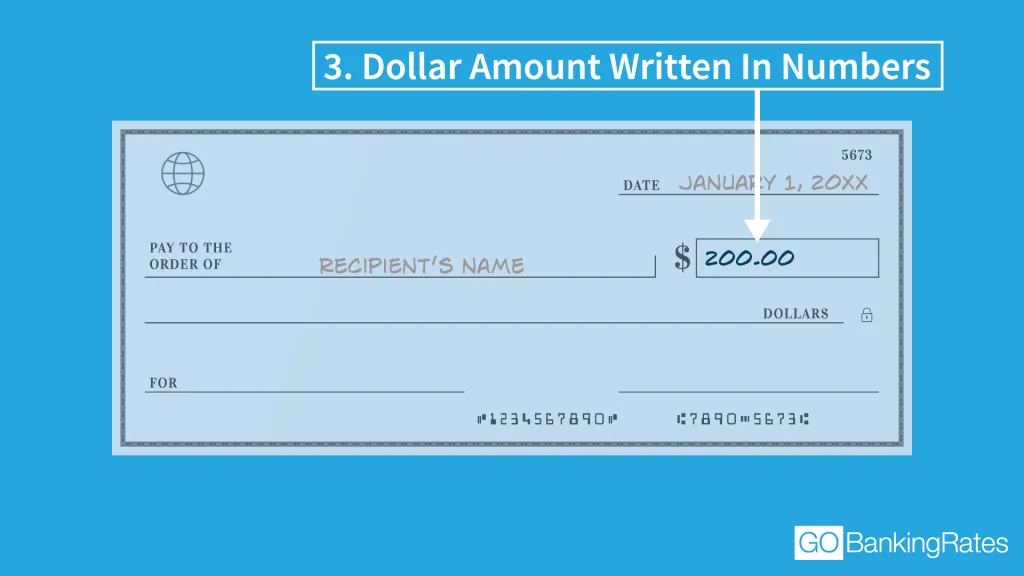

Step 3: Number Box or Dollar Box: Enter the dollar and cents amount using the number. In the dollar box.

Type in the dollars box: “80.00”

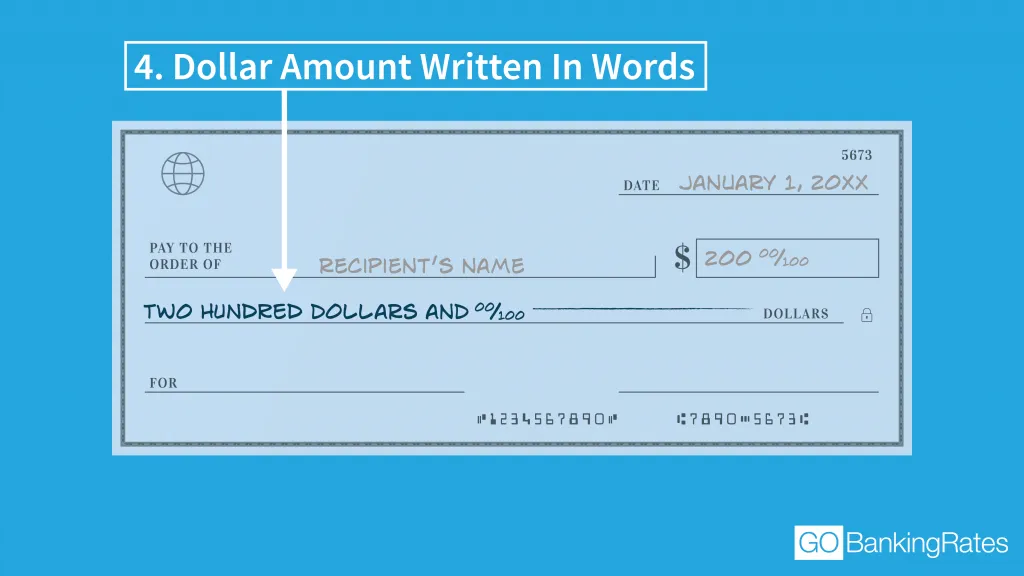

Step 4: Word Line: The dollar amount should also be written in expanded word form on the blank line below the recipient’s name. Cents, however, should be written in fraction form.

Let’s see the example, how to write an 80 dollars amount on this line.

“Eighty and 00/100”

Finally, draw a line in the blank section.

Also, you can fill in this line.

“Eighty and xx / 100” or “Eighty and No / 100”

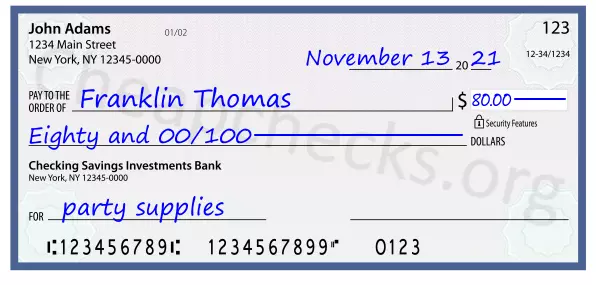

Step 5: Memo Line: What’s the reason for writing on the check. And Invoice or account number. You can write it in the memo section.

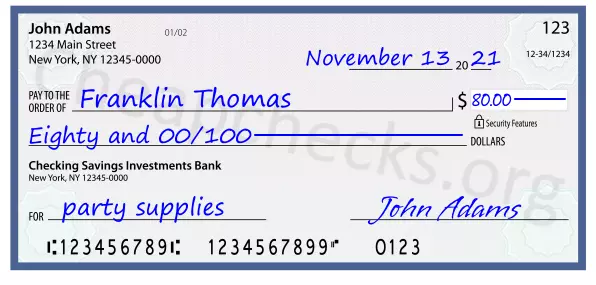

Step 6: Signature: Sign your name on the line at the bottom right corner of the check. Finally, if you have don’t sign, the check will be considered worthless.

Please note, if you enter “cash” in the provider, anyone can present a check for payment. But this approach is risky.

How to write a check for Eighty dollars with cents

Example No. 1: 80 dollars with 80 cents.

So, you have to type “80.80” in the dollar box and you have to type “eighty and 80/100” in the word index line.

Example No. 2: 80 dollars with 25 cents.

So, you have to type “80.25” in the dollar box and you have to type “eighty and 25/100” in the word index line.

How Do You Spell 80 and 80 USD

Summary of this post.

We hope that the information we give you on these articles is useful to you. If you search on your Search engine :

- How to write a check for 80 dollars,

- How to write 80 dollars in a check,

- How to complete a check for 80 dollars,

- How do you spell 80 dollars in English, You also found your answer.

So please, note the name of our website “CHECKMATTER.COM” .

As a result, it will be very easy for you to find our website. us on this site – how to write a check , how to complete a check , write a check , how to write a check amount, how to write a check with cents. Also, An accurate information or essay on how to write a check for $100 , $ 200 , $ 300, $ 400, $ 500 and various dollars. And how to cash a check. Presenting accurate information or articles about this.

If you are want to comment on this post. So complete the comment form and leave us a comment. Send us an email with our subject on how to write a check for other dollar numbers.

Variety of posts related to check that can be found on our home page. Then click on our category & menubar. Then you see how to write a check, how to fill out a check, and how to cash a check and many more articles.

We think you liked this post. So you read the article carefully at the end. Please , share it, like it, and bookmark our site.

Thank you, have a great day!

Related Articles

How to write a check for 831 dollars – check matter, how to write a check for 445 dollars – check matter, how to write a check for 672 dollars – check matter.

How To Write A Check for 80 Dollars with Cents

Even if you've never filled out a check before.

An Easy Visual Guide To Check Writing In 6 Steps

Checks are gradually being replaced by electronic payments. It's still important to know the steps to write a check. There are even some people or companies that will only accept checks.

Summary of The Six Steps To Properly Fill Out a Check for $80:

- Date : Write the date (for example "November 13, 2021") in the top right corner

- Payee : Write the person or company you are paying on "Pay To The Order Of" line. For example "Franklin Thomas"

- Amount in Numbers : Write the value "80.00" in numbers in the blank box to the right payee line

- Amount in Words : Write in words "Eighty and 00/100" on the line just below the payee line

- Memo : Write the details for you or the payee about the purpose of the check. For example "party supplies"

- Signature : Sign the check with the same signature that the bank has.

You'll see a sample check showing each step below.

Detailed Steps to Writing Out A Check for $80

Do all six steps in order and especially leave the signature until last. After the other steps.

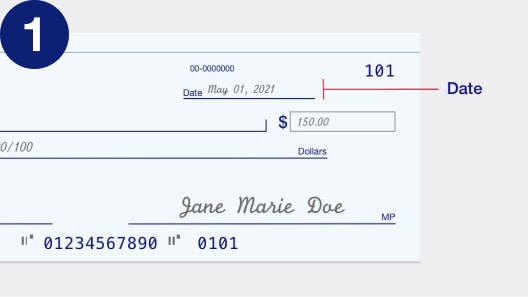

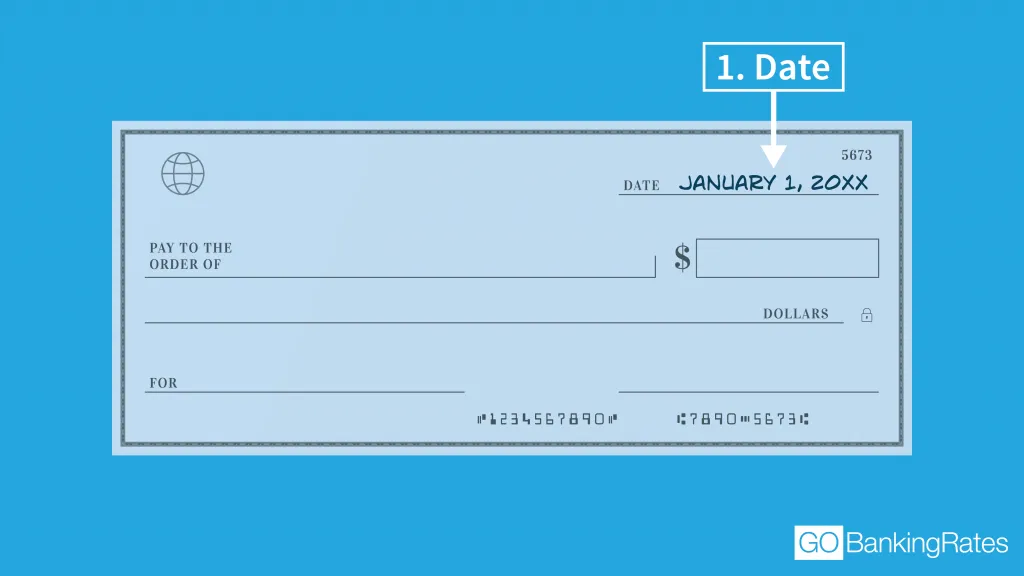

Step 1: Date

Write the date on the line in the top right of the check. Write the date in the normal way. November 13, 2021 or 11/13/2021, either are both acceptable.

Write today's date. This is the date you sign the check.

You can postdate a check using a future date, but in most states someone can still deposit the check now. You should avoid writing postdated checks if possible.

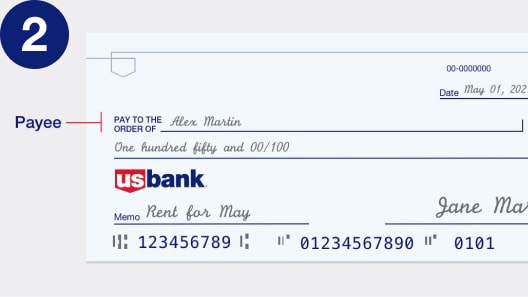

Step 2: Payee

Write the person or business you want to pay the amount to on the line the "Pay To The Order Of" line. For example "Franklin Thomas".

Use the first and last proper names not nicknames or abbreviations. If you don't know a correct company name then you should find out what it is.

Do not write the check out to "Cash" because anyone could cash the check.

How to fill out a check for $80.00 to yourself - just write your name as the payee!

If you are unsure check the spelling of the name. The bank could reject the check if it doesn't exactly match their records.

Step 3: Amount in Numbers

Write the value of the check in numbers in the blank box to the right of the Payee line.

Always add the full amount including cents (even if they are "no cents" or "even") after the whole dollar amount. Like this: "80.00" (shown with zero cents)

It's important to start at the left of the box, right after the $ sign. This leaves no space for anyone to add any extra numbers.

Make sure the number is clear and easy to read.

Ideally fill the width of the box. Or you can add a line after the numbers so there is no space for any alterations.

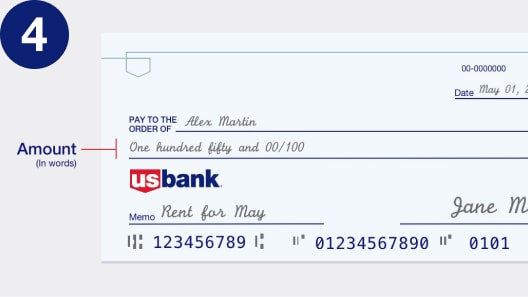

Step 4: Amount in Words

Below the Payee line spell out the check amount in words.

You write the cents as a fraction of a dollar. For example "Eighty and 00/100".

This will be the same amount as the previous step, just in words. Write them to match.

The amount in words is the legal value of the check, so make sure it is correct.

You can draw a line to the right of the amount to fill any space. Leaving no space for alteration of the amount.

Step 5: Memo

Write the purpose of the check on the memo (or "for") line at the check's bottom left.

For example "party supplies". This is optional, but can be useful later on.

The payee might want you to write your account, reference or an invoice number here.

You can also use this line to tell the Payee exactly what you want the check value used for.

This line can serve as a reminder. At tax time or when you can't remember exactly what your wrote the check for.

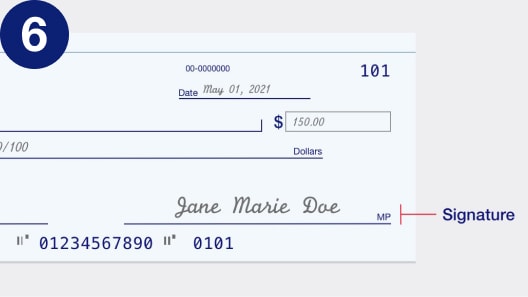

Step 6: Signature

After you are sure everything is correct and filled out properly you sign the check on the signature line.

The check is not valid until you sign it. When you sign it you are agreeing to pay the check value to the payee.

Make sure you use the same signature the bank has on record for that account.

The banks could reject the check if you don't write the correct signature.

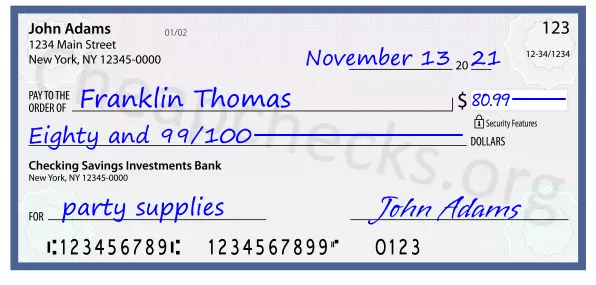

Writing a check for 80 dollars and 99 cents

Here's how to write a check with cents. The cents part of the amount as a number is just "99".

When you write the cents in words use a fraction. Like this "Eighty and 99/100"

Before you write a check

It is best to write the whole check in one go.

Make sure you know who you are paying and the amount you are paying them.

If you need any reference or account number then find it before you start to write the check.

Confirm you have enough funds in your account to cover the check.

After you write a check

Make sure you tear the check out carefully, keeping the check intact.

Save a record of the check in your check register. Making sure it will remind you of your purchase.

Having duplicate checks gives you a copy of the check automatically.

That's how to write 80 on a check.

- ATM locations

- ATM locator

Estás ingresando al nuevo sitio web de U.S. Bank en español.

What's your zip code, how to write a check, your guide to checking basics.

Whether you have never written a check or you’re in need of a refresher, learn how to write a check and properly fill out each field. Understanding the basics of check writing is as easy as 1-2-3.

Use this step-by-step guide to get it right every time.

Date the check

Add the date of when you wrote the check on the line at the top right-hand corner. This is important so the bank and the person you are giving the check to knows when you wrote it.

Tell the bank who to pay.

Find the “Pay to the order of” field and write the recipient’s full name. It’s important to write this clearly and accurately.

Write your payment amount in numbers

Use the small box to the right to indicate your payment amount in dollars and cents numerically (i.e.. $130.45).

Spell out your payment amount in words

Write the payment amount in words on the line below the recipient’s name. This must match the numerical dollar amount you wrote in the box. However, be sure to write the cents amount as a fraction over 100 (i.e. 10 cents = 10/100)

Use the memo field

Writing a memo is optional but helpful later to know what the check is for. For example, write “monthly rent” to help keep track of rent expenses. An image of the check is available in online and mobile banking. This is especially helpful during tax season.

Sign the check

Lastly, but most importantly, sign your name on the line at the bottom right-hand corner. Typically, a check cannot be deposited or cashed without your signature.

How to balance a checking account.

Keep track of your account balance to avoid bouncing a check and to avoid an overdraft fee. Best practice is to compare your checkbook register and bank account statement as well as any unlisted deposits and outstanding checking/withdrawals. If they match, your checking account is balanced.

Looking for a checking account for teens?

If you’re 13 through 17 years old, we’ve got special account benefits and features just for you. A checking account is a great way to teach kids financial responsibility. You can open a Bank Smartly Checking account for a minor aged 13 through 17 if it is a joint account with an adult. You may do so together online or in a branch.

Build a solid financial foundation.

Questions students should ask about checking accounts.

Banking basics: Building credit

Building confidence in your finances and career: Lessons from two fitness pros

Frequently asked questions, how do i void a check.

A voided check is used to set up direct deposits or bill pay. Simply write “VOID” across the pay to the order of line. Also, write “VOID” in the payment amount box and the signature box.

How do I write a check for cash?

You may want to write a check to yourself to withdraw cash from your bank account or transfer money between accounts. Simply write “Cash” in the pay to the order of line.

How old do I have to be to open an account?

You can apply for an individual bank account if you’re 18 years or older and a legal U.S. resident. You’ll need to provide your Social Security number and a valid, government-issued photo ID. Those aged 13 through 17 can open a joint account with a parent or guardian.

How do I set up direct deposit?

Set up direct deposit in three simple steps – our automated setup is fast, secure and gives you access to your money the same day.

Where can I find my routing number?

There are multiple places, including: the U.S. Bank Mobile App, online banking, your monthly statement, your checkbook and our routing number directory. The easiest way is to open the app and simply ask the U.S. Bank Smart Assistant, “What’s my routing number?”

How can I reorder checks?

Reordering checks couldn’t be easier. You can also customize your checks. There are multiple ways, including through: The U.S. Bank Mobile App, online banking, by phone or a branch.

How do I deposit a check?

With the U.S. Bank Mobile App, you can deposit a check anytime. Take a photo with your Smart Phone and upload it through the mobile app.

Get more answers to other commonly asked questions

Learn more about account services, features and benefits on our Customer services page.

Deposit products are offered by U.S. Bank National Association. Member FDIC.

By clicking Apply, you authorize your wireless carrier to use or disclose information about your account and your wireless device, if available, to us or our service provider for the duration of your business relationship, solely to help us identify you or your wireless device and to prevent fraud. See our Privacy Policy for how we treat your data.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Check in 6 Simple Steps

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

How to write a check in six easy steps:

Step 1: Include the date.

Step 2: Name the recipient.

Step 3: Fill in the amount with numerals.

Step 4: Write out the amount in words.

Step 5: Say what it's for.

Step 6: Sign your name.

Filling out a check used to be a habit for many people. But with debit cards, online banking and mobile payments, it's now a bit of a lost art. If you need help with how to write a check, these steps will have you covered.

Step 1. Include the date

This goes on the line in the top right corner of the check. If you're in the U.S., write it as month-date-year. You can choose to fill out the date completely or use numbers. For example, write June 20, 2023 or 6/20/2023.

Step 2. Name the recipient

Who will receive the check? Write their name on the line that begins with “Pay to the order of.” You can name a person or a business. For a person, be sure to use the full name and not a nickname.

Step 3. Fill in the amount with numerals

This is the easy part. Just write out in numbers how much you owe. In the animation above, the check is written for $900 and 50 cents.

Step 4. Write out the amount in words

Put this on the line below the “Pay to the order of” line. Add a cap so the recipient can't add money. Do this by including cents — use a fraction, such as 50/100 — or the word "even" if the amount is even. For example, say the amount on the check is $100; if you were only to write “one hundred dollars,” your recipient could potentially add some extra cents to the total if there’s space on the line.

Step 5. Say what it's for

Write this on the “Memo” line. This part is optional but handy. It helps you remember why you wrote the check.

Step 6. Sign your name

This goes in the bottom right-hand corner of the check. Note that your check will be rejected if you don't sign it. The signature is an indication that you’re agreeing to pay the amount on the check to the recipient.

Have more questions? Check out our FAQs section.

» Looking for top checking options? Check out our list of the best free checking accounts

Member FDIC

SoFi Checking and Savings

4.60% SoFi members with Direct Deposit or $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 4.60% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either Direct Deposit or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 10/24/2023. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet.

EverBank Performance℠ Savings

on Wealthfront's website

Wealthfront Cash Account

on Betterment's website

Betterment Cash Reserve – Paid non-client promotion

5.50% *Current promotional rate; annual percentage yield (variable) is 5.50% as of 4/2/24, plus a .50% boost available as a special offer with qualifying deposit. Terms apply; if the base APY increases or decreases, you’ll get the .75% boost on the updated rate. Cash Reserve is only available to clients of Betterment LLC, which is not a bank; cash transfers to program banks conducted through clients’ brokerage accounts at Betterment Securities.

Marcus by Goldman Sachs High-Yield CD

5.10% 5.10% APY (annual percentage yield) as of 04/29/2024

EverBank CD

5.05% 5.05% Annual Percentage Yield

Synchrony Bank CD

4.90% Annual Percentage Yields (APY) is subject to change at any time without notice. Offer applies to personal non-IRA accounts only. Fees may reduce earnings. For CD accounts, a penalty may be imposed for early withdrawals. After maturity, if your CD rolls over, you will earn the offered rate of interest in effect at that time. Visit synchronybank.com for current rates, terms and account requirements. Member FDIC.

5.00% 5.00% APY (annual percentage yield) as of 04/29/2024

Discover® Cashback Debit

Chase Total Checking®

Deposits are FDIC Insured

Chime Checking Account

Discover® Money Market Account

How to sign a check over to someone else

Signing over — also called endorsing — a check over to someone else requires a few steps. One example of when this is needed might be that your child receives a check and doesn’t have a bank account, so you want them to endorse their check over to you so that you can deposit it for safekeeping. Or perhaps you have a check written out to you that you want to sign over to your roommate so they can use it to cover your share of utilities.

However, before you begin the process of signing over a check, you may want to check with your recipient to make sure that their bank will accept a signed-over or “third party” check. Once you’ve confirmed that your endorsed check will be accepted, here’s what to do next:

Sign the back of your check in the endorsement area.

Write “Pay to the order of” and your recipient’s name.

Give the check to your recipient.

There’s a chance that your recipient’s bank might need your proof of identification, so you may want to plan on accompanying them to their bank when they deposit your check. Depending on the policies of their bank, your recipient may be able to make a mobile deposit of your endorsed check, but get in touch with their bank’s customer service to check.

» Want to dig deeper? Read more about the parts of a check

Alternatives to writing a check

If you would rather not write a check, here are two options that might work better for you.

Purchasing a money order or cashier’s check. Money orders and cashier’s checks — which can typically be purchased through your bank or through certain retailers in the case of money orders — can be nice alternatives to traditional checks because they take money out of your bank account upfront so that you don’t have to worry about waiting on your recipient to deposit your check.

» MORE: Can I cash a check at any bank?

Using a peer-to-peer payment app or digital wallet. Apps such as Venmo and Cash App and your smartphone’s built-in digital wallet like Apple Pay or Google Pay can all be good options for sending money instead of having to write a check. Zelle, a money transfer service that’s built into most banking apps, is also a good way to send money electronically. Just make sure that you’re sending money to the right person since it may be impossible to get your money back if it goes to the wrong recipient.

» Want to explore apps? Take a look at the top peer-to-peer payment options

If it’s a minor slip-up, draw a single line through the word and rewrite it. You may also need to write your initials next to the change. Whether your check is acceptable will be at the bank’s discretion. If you’re worried about whether it’ll be accepted, the safest option is to invalidate the check by writing “void” across it in large letters and writing a new check.

A postdated check has a future date written on it. For instance, if you’re mailing your December rent check on Nov. 28 but won’t have the necessary funds until the first of the month, you might date the check Dec. 1. However, postdating checks is not recommended and usually is a waste of time. The bank doesn't have to honor that later date, and overdraft or nonsufficient funds fees may apply if you don't have the money to cover it.

Instead of writing the word “even,” you can simply draw a straight line through the empty space that follows the written-out dollar amount. That way, fraudsters can’t add numbers to make the check worth more than you intended.

Yes, you can do so by naming yourself as the recipient. That’s one way to move money from one bank account to another. Either deposit the check at your new bank or use its mobile check deposit service, if it has one. Be sure to have a valid, government-issued photo ID.

Yes, you can, but it’s not a good idea since someone else could cash it if it fell into the wrong hands. If you still really want to write a check for cash, you write “Cash” as the payee in the “Pay to the Order of” line on the check.

A postdated check has a future date written on it. For instance, if you’re mailing your December rent check on Nov. 28 but won’t have the necessary funds until the first of the month, you might date the check Dec. 1. However,

postdating checks is not recommended

and usually is a waste of time. The bank doesn't have to honor that later date, and

or nonsufficient funds fees may apply if you don't have the money to cover it.

On a similar note...

Find a better checking account

See NerdWallet's picks for the best free checking accounts.

Great, you have saved this article to you My Learn Profile page.

Clicking a link will open a new window.

4 things you may not know about 529 plans

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some juristictions to falsely identify yourself in an email. All information you provide will be used solely for the purpose of sending the email on your behalf. The subject line of the email you send will be “Fidelity.com”.

Thanks for you sent email.

How to write a check

Key takeaways

- Writing a check can be done quickly in 6 simple steps.

- Be sure to double-check all information on your check before you hand it over.

Writing a check may seem like an old-school skill you don't need anymore. But there are times when paying by check is required or preferred, such as paying rent or sending a gift to a family member through the mail. This step-by-step guide can help you feel more confident while writing a check—and understand some tips to help keep your money safe.

Feed your brain. Fund your future.

Postdating is when you write in a future date with the idea that the person who's cashing the check will wait until that date or later. (Certain states have postdating guidelines, so learn whether yours does before doing this.) However, just because a check has been postdated doesn't mean the person receiving it or the bank cashing it must honor that date. That's one reason why it's important to only write checks for amounts you have the money to cover as soon as you've written the check.

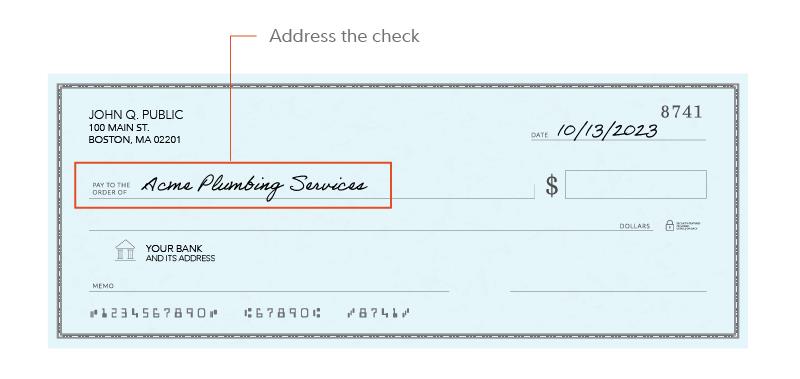

2. Address the check

Next, address the check to the person, business, or organization you are paying. You'll find this field below the date line toward the left of the check along with text reading "Pay to" or "Pay to the order of."

Use the full, complete name of the party that will cash the check. If it's someone you haven't paid before, verify what name to use. A local plumber, for instance, might need the check made out to the business they work for instead of their personal name.

If you want to make a withdrawal or transfer funds between accounts, you can write a check to yourself. Alternatively, you can address the check to "Cash." Be careful if you do this. Once written out to "Cash," anyone who finds the check can take it to a bank or financial institution and receive the check's value in cash.

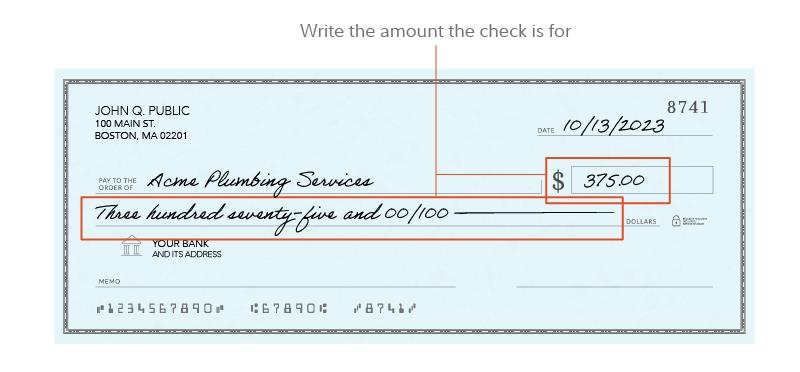

3. Write the amount the check is for

Beside and below the "Pay to" line, you'll write in how much money the check is for. To the right of "Pay to," you'll note the check's value in numerals (e.g., 375.00) in a box after a printed dollar sign. Then, on the line below with the word "Dollars" at the end, you'll spell out that amount ("Three hundred seventy-five dollars and 00/100"). It's a good idea to make a dash striking through any unused space on this line to prevent someone from writing in any additional amounts after you've handed off the check.

Do not write a check for an amount that's greater than what you have in your account. Having insufficient funds will cause checks to "bounce," which means they can't be cashed and may result in insufficient fund fees.

How to write a check with no cents

When your payment is for a whole number, simply put the number in the numerical box field using standard periods and zeroes to represent zero cents (e.g., 375.00). Then be sure to also spell out the amount in the written field below, noting either "00/100," "no/100," or "xx/100" to represent 0 cents (e.g., "Three hundred seventy-five dollars and 00/100").

How to write a check with cents

When your check includes cents, you'll need to write that out numerically and with words, just as you would a check with no cents. In the numerical box field, indicate any cents using a standard period and 2 digits (e.g., "375.62"). You'd then write out "Three hundred seventy-five dollars and 62/100" in the field below.

4. Sign the check

In the bottom right corner, you'll find a line that's typically labeled with "Signature" or "Authorized signature"—though sometimes it may have no text by it at all. This is where you'll sign the check to authorize payment.

5. Add a memo

This step isn't mandatory, but it's a good idea to fill in the memo (short for memorandum) field at the bottom left of the check. This is where you can include a note to remind yourself or the payee about the reason you're writing the check. If you're paying a plumber to fix your sink, you might note "Fix leaky kitchen sink."

6. Check your work

Be sure to look over your completed check at least once to confirm that all of the fields were completed correctly. Making a mistake when you write a check could lead to delays in payment or even loss of funds if someone unintended cashes the check.

What to do if you miswrite a check

If you make a mistake while writing a check, "void" it and start over. Voiding a check means that the check will not be able to be processed for payment. To void a check, cross out any part of the check that is filled out, and largely write "VOID" over the entirety of the check. This will ensure the check can't ever be used, and then you can make your payment using a different check.

What to do after writing a check

Once you've written a check, here's how to help ensure your funds get to the right place:

- Make a record of the transaction. Be sure to keep up with your transactions so you know any outstanding payments that debit your account. You might do this in a typical checkbook register, which you can often find at the front of a checkbook, or you may choose to use a financial app or spreadsheet to help you stay on top of things.

- Keep a record of your check as you wrote it. Take a picture of each check you write before you send it. This way you have an exact record of the document in case there are discrepancies later. Depending on your check type, you may also have duplicate carbon copy paper attached to your checks, creating a replica of the check as you write it.

- Monitor your account. Keep an eye on your bank account in the days and weeks to follow to make sure the check has been cashed or deposited as expected.

- Know how to stop payment on a check. If one of your checks winds up with an unintended recipient, you can contact your bank or credit union to stop them from issuing payment when someone tries to cash the check. Check with your financial institution to find out its process.

Security tips when writing checks

Consider following these security best practices:

- Use a pen. To prevent your check from being altered, always write checks with a non-erasable pen with ink that does not fade or smudge easily.

- Store your checkbook in a safe place. Checks contain sensitive info, like your account number and bank's routing number. If this information or a blank check fall into the wrong hands, someone could forge checks or wire themselves money directly from your account.

There's a better way to save and spend

Pay bills, track spending, and get ATM fee reimbursements with our Cash Management Solutions.

More to explore

Visit the fidelity learning center, how we can work together, subscribe to fidelity smart money ℠, looking for more ideas and insights, thanks for subscribing.

- Tell us the topics you want to learn more about

- View content you've saved for later

- Subscribe to our newsletters

We're on our way, but not quite there yet

Oh, hello again, thanks for subscribing to looking for more ideas and insights you might like these too:, looking for more ideas and insights you might like these too:, fidelity viewpoints ® timely news and insights from our pros on markets, investing, and personal finance. (debug tcm:2 ... decode crypto clarity on crypto every month. build your knowledge with education for all levels. fidelity smart money ℠ what the news means for your money, plus tips to help you spend, save, and invest. active investor our most advanced investment insights, strategies, and tools. insights from fidelity wealth management ℠ timely news, events, and wealth strategies from top fidelity thought leaders. women talk money real talk and helpful tips about money, investing, and careers. educational webinars and events free financial education from fidelity and other leading industry professionals. fidelity viewpoints ® timely news and insights from our pros on markets, investing, and personal finance. (debug tcm:2 ... decode crypto clarity on crypto every month. build your knowledge with education for all levels. fidelity smart money ℠ what the news means for your money, plus tips to help you spend, save, and invest. active investor our most advanced investment insights, strategies, and tools. insights from fidelity wealth management ℠ timely news, events, and wealth strategies from top fidelity thought leaders. women talk money real talk and helpful tips about money, investing, and careers. educational webinars and events free financial education from fidelity and other leading industry professionals. done add subscriptions no, thanks. saving and budgeting images are for illustrative purposes only. views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. unless otherwise noted, the opinions provided are those of the speaker or author and not necessarily those of fidelity investments or its affiliates. fidelity does not assume any duty to update any of the information. fidelity does not provide legal or tax advice. the information herein is general and educational in nature and should not be considered legal or tax advice. tax laws and regulations are complex and subject to change, which can materially affect investment results. fidelity cannot guarantee that the information herein is accurate, complete, or timely. fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. consult an attorney or tax professional regarding your specific situation. the fidelity investments and pyramid design logo is a registered service mark of fmr llc. the third-party trademarks and service marks appearing herein are the property of their respective owners. fidelity brokerage services llc, member nyse, sipc , 900 salem street, smithfield, ri 02917 © 2023 fmr llc. all rights reserved. 1111153.1.0 mutual funds etfs fixed income bonds cds options active trader pro investor centers stocks online trading annuities life insurance & long term care small business retirement plans 529 plans iras retirement products retirement planning charitable giving fidsafe , (opens in a new window) finra's brokercheck , (opens in a new window) health savings account stay connected.

- News Releases

- About Fidelity

- International

- Terms of Use

- Accessibility

- Contact Us , (Opens in a new window)

- Disclosures , (Opens in a new window)

How to write a check: A step-by-step guide

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

At Bankrate, we take the accuracy of our content seriously.

“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

- • Personal finance

- • Savings accounts

- • Financial planning

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Here is a list of our banking partners .

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

In this article

Parts of a check

Steps to fill out a check, additional tips for writing a check, faqs about checks.

Our writers and editors used an in-house natural language generation platform to assist with portions of this article, allowing them to focus on adding information that is uniquely helpful. The article was reviewed, fact-checked and edited by our editorial staff prior to publication.

If you haven’t written one in a while (or ever), here’s a handy guide on how to write a check.

Key takeaways

- Checks are still a valid form of payment, but are less commonly used due to the rise of electronic payments.

- It’s important to fill out a check accurately and legibly, as any errors can cause issues with the transaction.

- It’s important to keep a record of checks written and payments made to organize your personal finances.

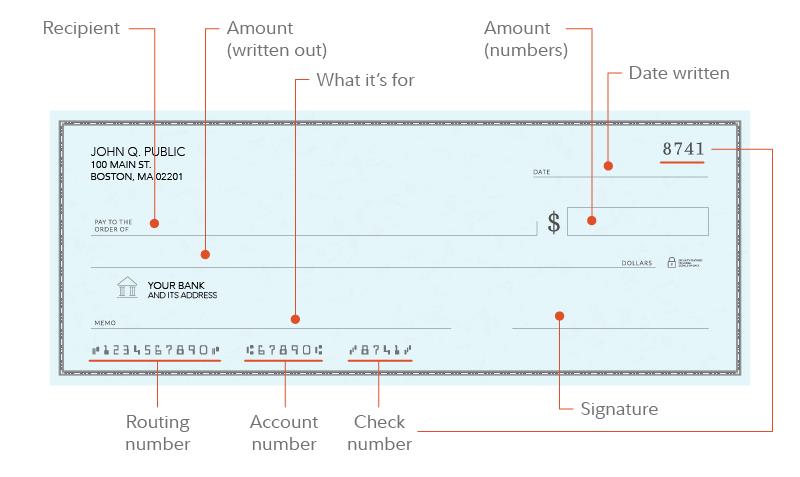

The parts of a typical check include:

- Your personal details: Positioned in the top left corner, these details include your name and the address linked to your bank account.

- Check number: Found in both the top and bottom right corners, this number is used for tracking and security purposes.

- Date line: This is where you specify the date for the intended transaction.

- “Pay to the order of” line: This is where you write the recipient’s name.

- Box for the dollar amount: This is where you note down the amount numerically.

- Line for the dollar amount: This is where you write the check amount, in words.

- Memo line: A feature that gives you the option to indicate the purpose of the check.

- Name of the bank: Usually accompanied by its logo or address.

- Routing number: The initial series of numbers at the bottom left that identify your bank.

- Your account number : The second series of numbers at the bottom that indicate the account from which the funds will be withdrawn.

- Signature line: Where you sign your name to authorize the funds to be drawn.

These days, many consumers send money electronically , but on occasion it may still be necessary to pay by paper check. Checks can be ordered from banks or third-party printers.

It’s important to note that there are several different types of checks, including personal checks , cashier’s checks and traveler’s checks. Though they may come with different fees and different ordering protocols, the way you fill out each check is generally the same.

Before writing a check, you’ll need to have a checking account with sufficient funds to cover the amount of the check. Then, here are the steps to fill one out.

1. Fill in the date

Write the current date on the line at the top right-hand corner. This information notifies the financial institution and the recipient of when you wrote it. The date can be written in long form or all numbers. Either 1/11/2024 or Jan. 11, 2024, could work, for example.

2. Write the name of the payee

On the line that says “Pay to the order of,” write the name of the individual or company you’d like to pay, known as the payee. Use the payee’s full name instead of a nickname. If you don’t know the exact name, you can write “cash” here. Be aware that if a check is made out to cash, anyone can cash or deposit it.

3. Write the check amount in numeric form

There are two places on a check for stating the amount you’re paying. The first is a small box to the right of the line for the recipient’s name. Write the numerical dollar amount in this box. For example, you may write $100.30 if you wish to write a check for one hundred dollars and thirty cents. Make sure you write this clearly so that the bank can subtract the correct amount from your account.

4. Write the check amount in words

Next, write out the dollar amount in words on the line below “Pay to the order of,” making sure it matches the numerical amount. Add the cent amount over 100. For example, if you wrote $100.30 in the box, you’ll write “One hundred and 30/100.” If the check is for $100 or another round number, still include 00/100 after the dollar amount for clarity.

5. Write a memo

The memo section of the check is optional, but it’s a good idea to fill it out because it can serve as a reminder of what the check is for. If you’re writing the check to pay for a haircut, for example, you can write “haircut.” A company may ask you to write your account number or invoice number in this section, which helps ensure the payment is applied to the correct account. You would also write your account number in the memo area if the check’s for a bill payment.

6. Sign the check

Sign your name on the line at the check’s bottom right-hand corner. Sign legibly, and make sure to use the same signature on file at your bank. A signature confirms to the bank that you agree to pay the stated amount to the payee.

That’s it; your check should be all set to make a payment!

- Always use a pen instead of a pencil when filling out a check, to avoid alterations.

- Write legibly to prevent any confusion.

- Double-check the details on the check before handing it over to ensure accuracy.

- Keep track of check numbers and maintain records of checks paid. That way you’ll have a record of the payment if there’s any question about whether a certain expense was paid or how much you spent.

Can I write a check to myself?

What is a postdated check, how should i fix a mistake on a check, bottom line.

With the rise of digital payment methods, writing checks has become less common, but it is still essential to know how to fill one out correctly in case the need ever arises. By following the steps outlined above and double-checking all of the information you’ve written out, you can make sure that your check payments will be processed accurately and securely.

–Freelance writer Anna Baluch contributed to a previous version of this article.

How to deposit a check

What is direct deposit? Here’s how it works

Best Checking Accounts

How to Write a Check

Follow these steps to fill out a check completely and accurately.

Getty Images

With electronic fund transfers becoming more and more popular, here is a reminder of the lost art of check writing.

Although most consumers rely heavily on credit cards, debit cards and other digital payment methods, Americans still have to write checks occasionally. But in 2018, the number of electronic fund transfers in the U.S. exceeded the number of checks written for the first time, and the use of checks has continued to fall since then.

So, if you're dedicated to digital payments but need to write a check, would you know how to do it? Follow these step-by-step directions for how to write a check.

Steps for how to write a check

- Write the date.

- Write the recipient.

- Fill in the dollar amount in numerals.

- Write out the dollar amount.

- Sign the check.

- Fill out the memo line.

1. Write the Date

In the upper-right corner of the check, you'll see a line marked "Date." On that line, put the date that you're writing the check, not an earlier or later date.

It's best practice to write out the month rather than using a number. This way, you won't mix up the digits for the month and day. So, instead of writing 4/15/2023, you'd want to write April 15, 2023. Don’t worry if you fail to follow this month-day-year format, though, as long as the date is written correctly.

2. Write the Recipient

Next, look for the "Pay to the order of" line. That's where you'll write the name of the check's recipient. For instance, if your apartment landlord is called World's Best Landlord, you'd put that name on the "Pay to the order of" line.

Be sure to spell out the name of the recipient in full rather than abbreviating it.

3. Fill in the Dollar Amount in Numerals

To the right of the "Pay to the order of" line is a box preceded by a dollar sign. That's where you'll write the dollar amount of the check.

So, if you're paying $800 to your landlord for monthly rent, you'd write "800.00" in the box to represent the dollars and cents. Make sure the dollar amount is shown numerically. In other words, don't substitute 800 with "Eight hundred."

4. Write Out the Dollar Amount

Below the "Pay to the order of" line is a line where you'll write out the dollar amount of the check. It should be the same as the numerical value you put in the box. Writing the number twice helps a bank verify the dollar amount of the check.

Sticking with the $800 rent example, you'd write "Eight hundred and 00/100" on this line. Even if there are no cents included in the amount, you should include "00/100" after the preceding number.

If the amount of the check was $800.50, you'd write "Eight hundred and 50/100." And if the amount was $859, you'd write "Eight hundred fifty-nine and 00/100."

5. Sign the Check

At the bottom-right corner of the check is a line where you, the account holder, need to put your signature. This signature should match the name and signature you provided when you opened your account.

6. Fill Out the Memo Line

In the bottom-left corner of the check is a line preceded by the word "For" or "Memo" where you can jot down a few words explaining the purpose of the check. For instance, you might put "April rent" on this line if the check is covering your rent payment for April.

What Else Should You See on Your Check?

Aside from the information you write on a check, look for these features printed on the document:

- The check number, such as 101, in the upper-right corner.

- Your name, address, city, state and ZIP code somewhere to the left of the line for the date.

- The name of the financial institution.

- The nine-digit routing number in the corner below the "For" or "Memo" line. This number uniquely identifies your financial institution.

- Your account number. This number normally appears directly to the right of the routing number. It typically is anywhere from eight to 12 digits, but might be as long as 17 digits. The account number tells your financial institution which account should be tapped to cover the check.

How to Wire Money

John Egan Jan. 23, 2023

Tips for Writing a Check

Follow these seven tips to make sure your check will be processed without any problems.

- Write neatly so that everything can be easily read.

- Fill it out in permanent blue or black ink.

- Sign the check in cursive rather than printing your name.

- Don't put a date on the check that's before (predated) or after the date (postdated) when you're writing the check.

- Draw a line to fill any gap on the "Pay to the order of" line and "Dollars" line. The line should extend from the end of what you've written to the end of the space. Filling in empty space with a line prevents someone from adding unauthorized information after you've written the check.

- If you need to make a correction, initial the change you've made.

- Make sure there's enough money in your account to cover the check. Otherwise, you run the risk of the check being returned to you, and you could wind up being charged a nonsufficient funds fee or overdraft fee.

Tags: banking

Popular Stories

Banking Advice

Best of Banking

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

GOBankingRates works with many financial advertisers to showcase their products and services to our audiences. These brands compensate us to advertise their products in ads across our site. This compensation may impact how and where products appear on this site. We are not a comparison-tool and these offers do not represent all available deposit, investment, loan or credit products.

How To Write a Check: A Step-By-Step Guide (with Pictures)

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology .

20 Years Helping You Live Richer

Reviewed by Experts

Trusted by Millions of Readers

While it’s so easy to simply swipe your debit card at the cash register or to pay your bills online, the paper check has not yet met its demise . There are times when writing a check is the easiest way — or the only way — to pay for goods or services.

As long as it’s considered a valid form of payment, you should know how checks are written. Follow this guide using written check examples so you can avoid any mistakes.

Here’s How To Write a Check — With Sample Check Examples

Knowing how to write a check can help you avoid costly errors. It’s a good idea to fill in the check from top to bottom so you don’t miss a label.

Financial institution Capital One recommends using a pen to write the check and also to print all words except your signature to make them easier to read. Read on for a step-by-step example of a check filled out from top to bottom.

1. Write the Date

Write the correct date in the date label near the upper right corner of the check. Use the current month, day and year. You can postdate a check by writing a future date in the hope that it won’t be cashed until then. However, your account must have enough money to cover the check because the bank can accept a check at any time. The Consumer Financial Protection Bureau says a financial institution is not required to wait for the date on the check.

2. Write the Recipient’s Name

Write the full, proper name of the person or company receiving the check on the “pay to” line. You’ll find it in the middle of the check, labeled “Pay to the order of.”

How Do I Write Myself a Check?

You can write your name on the “pay to” line and deposit or cash the check like you would a check someone else had written to you. Alternatively, you can write the check to “Cash,” but keep in mind that doing so can be risky since anyone can cash a check written to cash.

3. Write the Amount in Numbers

You will write the check’s amount in two places. The first is the box to the right of the “pay to” line. That’s where you write the check’s amount in dollars and cents separated by a decimal point. Write the first digit as close as possible to the dollar sign and use a decimal point between the dollar s and cents. Even if there are no cents, include a decimal point and two zeros or two zeros over one hundred, like it’s written in the photo below. This prevents other people from altering the amount of the check.

4. Write the Dollar Amount in Words

The second place you write the check’s amount is under the “pay to” line. Here, you’ll spell out the check amount. The amount written out on the line must match what you wrote in the box above the line. This serves as an additional confirmation of the amount the check is written for. The word “and” is used to indicate the decimal point and should always be used.

How To Write Cents on a Check

You might find yourself wondering: How do you write a check for $1,500.75? Start by writing the dollar amount in words, then express the cents as a fraction using xx/100. So, in this example, write “One thousand, five hundred and 75/100” to indicate the dollar amount and 75 cents. Because the word “dollars” is printed on the check, you do not need to write that yourself.

5. Add a Memo

The memo line in the bottom left corner of the check is where you can write a note, such as one that indicates the purpose of the check for your record keeping. You can also write a note that indicates your account number when paying a bill to help your payment get properly credited.

6. Write Your Signature

After you’ve filled out all the other sections of the check, sign the check on the signature line in the bottom right corner. Your signature indicates to your financial institution that you want to pay the payee the amount written on the check and have the funds subtracted from your account balance. Use the same signature style your bank has on file. If your signature looks different from the bank records, your check may not be valid.

Remember to Record the Checks You Write

Even though you might not write many checks, it’s still important to have a record of those you do write and subtract their amounts from your bank balance to know just how much money you have in your account .

Keeping a record of checks you’ve written is easy. When you receive your checks from the printer, you should also receive a check register. A check register is where you can record not only any checks you write but also any deposits or withdrawals you make, as well as debit card purchases. This helps you keep a running record of your bank account balance. For each check you write, you’ll need to record the number of the check, the date, the payee and the amount paid in the check register.

If writing in a check register isn’t preferable, you can keep a record of your transactions, including checks, in an electronic spreadsheet or a financial tracking app . Your record-keeping method doesn’t really matter as long as it’s effective in helping you keep tabs on the amount of money you have.

What if You Make a Mistake?

Even the most experienced check writer can make an error when making out a check. If you write a check for $1,000 but you meant to make out the check for $1,050, write “VOID” across the front and back of the check, and be sure to mark the check number as void in your check register or on your spreadsheet.

If you have a paper shredder, take advantage of it. Should a fraudster get a hold of your voided check, it can’t be cashed, but it still contains valuable information that could lead to identity theft .

Check Writing Safety Tips and Takeaways

Check fraud includes forging or endorsing checks that belong to someone else, using chemicals to remove information from a check, and stealing or counterfeiting checks that belong to another person. If you use checks, even rarely, make sure you know how to protect yourself from check fraud.

Ways To Prevent Fraud

Take these precautions to avoid being a fraud victim:

- Use pigment-ink pens to write checks.

- Fill out the entire check before signing it.

- Keep your signature consistent.

- If you make a mistake, write the word “VOID” in capital letters across the entire front of the check before shredding it or tearing it up.

The bank may refuse to reimburse you for loss resulting from check fraud if it can prove the fraud was the result of your own negligence.

More on Checking Account

What is a checking account and how does it work.

- 7 Types of Checking Accounts

- Checking vs. Savings Accounts

- How Many Checking Accounts Should You Have?

- How Much You Should Have in Your Checking Account

- What Do You Need To Open a Checking Account?

Virginia Anderson , Jami Farkas , Cynthia Measom , Daria Uhlig , Sean Dennison and Barb Nefer contributed to the reporting for this article.

This article has been updated with additional reporting since its original publication.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy .

- Members First Credit Union of Florida. 2022. "What to Shred and When to Shred It."

- Consumer Financial Protection Bureau. "Can a bank or credit union cash a post-dated check before the date on the check?"

- HelpWithMyBank.gov. "The bank said forged checks were due to my negligence. What can I do?"

Share This Article:

- Best Free Checking with No Minimum Balance

- Best Free Checking with No Minimum Deposit

- Best Checking Account Bonuses This Month

Learn More About Checking Accounts

- What is a Checking Account?

- Types of Checking Accounts

- Checking Accounts vs Savings Accounts

- How Much Money Should You Keep In Your Checking Account?

- How to Open a Checking Account

- How to Write a Check

GOBankingRates' Best Banks

- Best High-Yield Savings Accounts

- Best Checking Accounts

- Best CD Accounts & Rates

- Best Online Banks

- Best National Banks

- Best Neobanks

- Best Money Market Accounts

- Best Premium Checking Accounts

- Best Regional Banks

Related Content

Checking Account

Best Checking Accounts May 2024

May 09, 2024

I'm a Financial Planning Expert: Here's How Much Money Boomers Should Have in Their Checking Accounts

9 Banks With Completely Free Checking And No Minimum Balance of May 2024

May 08, 2024

What Is Direct Deposit? How It Works and How You Can Set It Up

How To Cash a Check Without a Bank Account or ID

May 07, 2024

6 Things To Do Now If You Have More Than $5,000 in Your Checking Account

May 05, 2024

Best Joint Checking Accounts of May 2024

May 03, 2024

Uncategorized

May 02, 2024

10 Best Rewards Checking Accounts for May 2024

5 Best Teen Checking Accounts for May 2024

May 13, 2024

Bank Routing Numbers: What They Are and How To Find Them

What Are Joint Bank Accounts and How Do They Work?

April 29, 2024

Chase Overdraft Fees: How Much They Cost and How To Avoid Them

April 30, 2024

How Long Does Direct Deposit Take?

Best Places To Buy Cheap Personal Checks

How To Open a Chase Checking Account

April 19, 2024

Make your money work for you

Get the latest news on investing, money, and more with our free newsletter.

By subscribing, you agree to our Terms of Use and Privacy Policy . Unsubscribe at any time.

You're Subscribed!

Check your inbox for more details.

BEFORE YOU GO

See today's best banking offers.

Sending you timely financial stories that you can bank on.

Sign up for our daily newsletter for the latest financial news and trending topics.

For our full Privacy Policy, click here .

How to Write a Check

Not everyone uses checks super frequently, so sometimes it helps to have a refresher on how to write a check, just to make sure you get it right.

You may not use paper checks very frequently, or maybe you do! Either way, knowing how to write a check is a great skill for anyone to have, just in case. Writing out a check may seem complicated at first since there are 7 different fields to know about, but once you know what these 7 fields mean, you'll find writing out a check easy to do.

While you're learning about how to write a check correctly, you can also make use of Check City's convenient and simple check cashing services .

What is a Check?

Checks are a form of paper payment. A personal check is a written financial statement that allows a bank to pay the check recipient through the check sender's checking account. But there are also many other different kinds of checks aside from personal ones.

Paper checks are a kind of paper payment that allows a bank to take money from the bank account of whoever wrote the check (the check writer), to pay whoever is depositing the check (the check recipient). You can get your own checkbook full of checks through your bank or credit union.

How to Write Out a Check

Learning how to write out a check might seem complicated, but it's really easy once you know what goes in each check field. Listed below are all the different fields in a check. You need to understand what each section is for in order to know how to fill each one out.

Field #1: Date

In the top right-hand corner of the check, you'll find the date line. Usually, you'll just write the current date, but one of the great things about checks is that you can post-date it, meaning you write a future date on the check to ensure it can only be deposited after the date you mark down. So if you need to pay someone, but need them to wait until payday, you can still hand them the check now.

Field #2: Pay to the Order of

This line is where you write who you are writing the check for. This might be the name of a person or the name of a company or organization. For example, if you're using a check to pay for groceries at the grocery store, then the name you'll put here is the name of the grocery store.

Field #3: Dollar Box

In this box, you write the payment amount of the check in numerals. So instead of writing "one hundred dollars" you write "100.00."

Field #4: Dollars Line

Then there's a line with the word "Dollars" at the end of it. Here is where you write the monetary amount of the check in words. So instead of writing "100.00", you write "one hundred and 0/100."

Field #5: Memo

The memo is where you write a note about what the check is for. You can fill out this section for your own files so that the check stub has the check's purpose written on it too. The memo section can also let the person receiving the check know what the check is meant to be used for.

You don’t have to fill out this section but it can help to do so, to not forget why you wrote out the check in the first place.

Field #6: Signature Line

Here is where you sign the check.

Field #7: Check Numbers

At the bottom of each check you'll find 3 sets of numbers. The first set of numbers is the routing number, the second set of numbers is the account number, and the final set of numbers is the individual check number.

*Quick Tip: Keep the check stub and use it for your files. The check stub is the thinner paper copy behind the check that gets written on as you write out the check. This gives you a hard copy of the check you wrote for your own checkbook balancing and financial records.

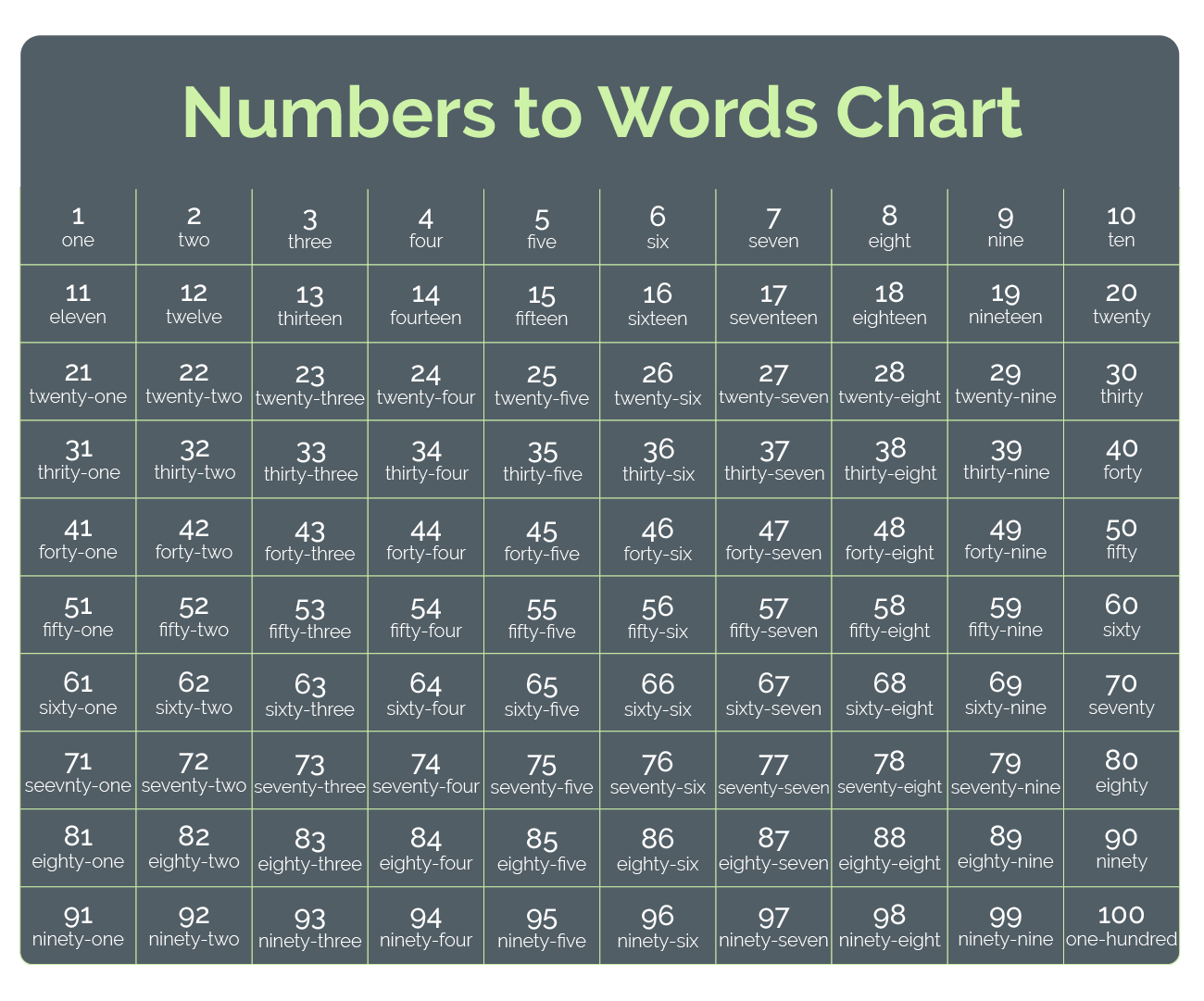

How to Write a Check Amount

Learn how to write a check amount so you can comfortably write out any number in words! If you have any questions about how to write your specific dollar amount you can take a look at the charts below. A printable number chart is also available by clicking here.

But let's quickly go over some frequently asked number to words questions:

How to spell 90: ninety

How to write a check for 1,000: In the Dollar box you would write, "1,000.00" and in the Dollar line you would write, "one thousand and 0/100."

How to write a check for 1,500: In the Dollar box you would write, "1,500.00" and in the Dollar line you would write, "one thousand, five hundred and 0/100."

How to write a check for 100 dollars: In the Dollar box you would write, "100.00" and in the Dollar line you would write, "one hundred and 0/100."

How to Write a Check with Cents

A lot of people have questions about how to write a check with cents. Have no worries! This is the easiest part of the check because you can still write the cent amount out in numerals.

After you write out the dollar amount in words, you write "and" and then write the number of cents in numerals over 100.

For example: If you want to write a check out for $100.50, you would write on the Dollars line, "one hundred and 50/100."

How to Balance a Checkbook

In the back of your checkbook, there is a check registry—extra pages with a chart to record key information from each transaction. Whenever you write a check, keep the check stub to make filling out the check registry later easier.

Field #1: Write the same date on the check on its line in the check register.

Field #2: In the description, column write the same things you would write on the "Pay to the Order of" and the memo line.

Field #3: In the "payment/debit" column write down the amount you paid.

In the deposit/credit column record deposits to your own account, like when you deposit a check into your own account.

In the balance column keep track of your total account balance, adding deposits to your account, and subtracting transactions you've paid.

Field #7: Write out the check ID number. It's the last couple of numbers at the bottom of the check. This way you'll know exactly which check in your checkbook went to what, including which are voided checks .

Keep Learning

Article sources.

Payday Loans are also commonly referred to as Cash Advances, Payday Advances, Payday Advance Loans, and Fast Cash Loans. Check City may, at its discretion, verify application information by using national consumer loan underwriting databases that may include information relating to previous cash advance transactions that Check City may take into consideration in the approval process. Approval, products, and loan terms may vary based on applicant qualifications and applicable state or federal law. See Rates and Fees for specific information and requirements. Some customers applying for payday loans or installment loans may be required to submit additional documentation due to state law and qualification criteria. CheckCity.com provides loan services in: Alabama, Alaska, California, Idaho, Kansas, Missouri, Nevada, Ohio, Utah, Wisconsin, and Wyoming. In Texas, CheckCity.com acts as a credit services organization/credit access business (CSO/CAB) and will not be the lender for loans obtained through this site; CheckCity.com will instead attempt to arrange a loan between you and an unaffiliated third-party lender. Customer Notice: A single payday advance is typically for two to four weeks. However, borrowers often use these loans over a period of months, which can be expensive. Payday advances are not recommended as long-term financial solutions. Loan proceeds issued through our website are generally deposited via ACH for next business day delivery if approved by 8pm CT Mon. – Fri. This is an invitation to send a loan application, not an offer to make a short-term loan. This service does not constitute an offer or solicitation for payday loans in Arizona, Arkansas, Colorado, Georgia, Maryland, Massachusetts, New York, Pennsylvania, or West Virginia. Tosh of Utah, Inc. dba Check City Check Cashing, a payday lender, is licensed by the Virginia State Corporation Commission (License #PL-57). Anykind Check Cashing, LC. dba Check City, a payday lender, is licensed by the Virginia State Corporation Commission (License #PL-21). The maximum funded amount for payday loans or installment loans depends on qualification criteria and state law. See Rates and Terms for details. Utah Customers: For consumer questions or complaints regarding payday loans and/or title loans you may contact our Customer Service Department toll-free at (866) 258-4672. You may also contact our regulator The Utah Department of Financial Institutions at (801) 538-8830. In California, CheckCity.com is licensed by the California Department of Financial Protection and Innovation pursuant to the California Deferred Deposit Transaction Law, Cal. Fin. Code D. 10. Please see Rates and Terms to check the availability of online loans in your state. Check City does not provide loan services in all states.

A Step-by-Step Guide on How to Properly Write a Check

We get it: When you have to start writing out hundreds and thousands, it gets confusing.

Know your numbers

How to write a check, record your check, tips for writing checks.

My dad was a banker when I was growing up, so he emphasized the importance of financial literacy even when my little brother and I were still at the piggy bank stage. When our elementary school started a student-run bank to teach us about saving, we were among the first ones in line to open bank accounts so our hard-won allowance money could start earning interest. I still remember how proud I felt holding my very first checkbook at the ripe old age of 10.

Decades later, my checkbook spends most of its time in my desk drawer. In the age of online bill payment systems and credit card points, I write relatively few checks these days. But when I do, I can still picture my dad leaning over my child-sized hands, showing me where to put each of the crucial bits of information to ensure it's filled out correctly. If you're like me and sometimes have to pause to remember how to write a check when it's time to pay rent, bills or other expenses, we're here to help. This step-by-step guide will ensure you don't miss any.

Before writing a check

You know what they say: An ounce of prevention is worth a pound of cure. Save yourself a headache later by first making sure you've got the funds in your account to cover the check you're writing, especially if it might be close. If your check bounces, which is what happens when there isn't enough money in your account to cover it, that can lead to penalty fees from your bank or other legal concerns.

And if you can, consider using alternate payment methods that might be greener, not to mention save you the hassle of filling out a check and reordering more when they run out. Many companies offer online bill-pay, including automatic payments so you can set it and forget it. Using a debit card instead of writing a check will also create an automatic record of your transactions, so you don't have to worry about doing that yourself.

When you're looking at a check, there are a few numbers you'll need to know. These are important because they indicate which check you're writing so you can keep track of it, as well as the account it's coming from and the bank where it's held.

- Bank routing number. This is the unique identification number for your bank. It's also the number you'll be asked for if you're using online bill pay when they ask for the routing number.

- Account number. This is your individual checking account.

- Check number. This one indicates which check you're using. You'll want to record this in the check registry (more on that later) so you know which checks you're using for which transactions.

When you're filling out a check — in pen, don't forget! — take care to use each field correctly so you don't have to start over and waste checks. Always write legibly and use both numbers and letters where indicated, so there's no question about how much you want your bank to take out of your account and who it's going to.

Here's where everything goes.

- Date. Put the date you're writing the check in the field in the upper right corner. That will tell the person who's receiving it when you wrote it. If you need to postdate a check, write in a future date that will indicate when it can be cashed. You may need to do this if you're sending a check earlier than when it's due and you don't have the funds to cover it at the exact moment, or just don't want the money taken out until it's time.

- Payee. Next to where it says "pay to the order of," write the name of the person or business that will receive the check.

- Check amount (numerical). Here's where you write the amount the check is for in digit form. Fill the entire box so no one can add extra numbers and increase the amount the check is for. For example, if you're writing a check for $250, you can write $250.00 to fill the entire box and make sure there's no confusion about the exact amount.

- Check amount (text). Below the payee line and to the left of where it says "dollars," write out the amount the check is for in words. Writing it out in both words and numerals ensures there's no confusion over the amount. You want to fill in the entire line here, too. If you're writing a check for $250, you'd write, "two hundred and fifty and 00/100." Instead of writing out cents, you would put the cent amount slash 100. In that case, if you're writing a check for $15.50, you'd write, "fifteen and 50/100." The "dollars" part is already printed on the check so no need to write that out.

- Memo. This is where you write what the check is for. It's not legally required, but will help you track your check if there are any issues. Get as detailed as will be helpful for your own records.

- Signature. Finally, sign your check on the line in the bottom right corner to indicate you agree to pay the amount above to the person or company you've designated to receive it. The check isn't valid until you sign it, so don't forget this step.

After you've written your check, it's a good idea to record it in your check register. You can use the register that comes with your checks, a spreadsheet or any other method that works for your money management system.

Your records should include:

- Check number

- Date the check was written

- Payee, or who you wrote it to

- A memo detailing what the check was for

Both before and after you write a check, it's important to make sure it's secure so you don't fall victim to bank fraud. Here are a few tips to make sure your check is safe.

- Use pen. Fill out your check in blue or black permanent ink instead of pencil. That will ensure no one can change the fields after you fill them out.