An Assessment of Competitiveness of Technology-Based Startups in India

- Original Research

- Published: 17 May 2021

- Volume 16 , pages 28–38, ( 2021 )

Cite this article

- Krishna Satyanarayana ORCID: orcid.org/0000-0001-9577-0558 ,

- Deepak Chandrashekar ORCID: orcid.org/0000-0002-9128-3418 1 &

- Bala Subrahmanya Mungila Hillemane ORCID: orcid.org/0000-0001-8745-6147 2

7636 Accesses

15 Citations

Explore all metrics

A Correction to this article was published on 03 August 2021

This article has been updated

This paper examines the role played by the entrepreneurial, firm-specific and external environment-related parameters in impacting the competitiveness of Indian high-tech start-ups, considering start-up survival as a milestone and using survival analysis techniques for the analysis. The study uses primary data collected from 175 Indian high-tech start-ups that are headquartered across the country, using a semi-structured questionnaire and in-depth interviews with the top-level management of the sample firms for analysis. Among the firm-related factors, sales and R&D capabilities of the start-ups have shown to be of paramount importance in influencing the competitiveness of high-tech start-ups. Further, among the external environment-specific attributes, the SDP growth in the region is shown to have significant influence on the competitiveness of high-tech start-ups (borderline significant). This paper makes a key contribution to the existing literature by empirically identifying the key entrepreneur-specific, firm-specific and external environment-specific factors of a firm that influence the competitiveness of high-tech start-ups that are in pre-growth stage in a developing economy. The findings of the study will help start-up owners and policy-makers to make adjustments in their policy-making and strategy to enhance the competitiveness of the technology-based startups operating in India.

Similar content being viewed by others

Realizing expectations? High-impact entrepreneurship across countries

Digital innovation in entrepreneurial firms: a systematic literature review

Big data analytics capabilities: a systematic literature review and research agenda.

Avoid common mistakes on your manuscript.

Introduction

As nations transition into knowledge driven economies, technology-based entrepreneurship has emerged as a credible instrument of job creation, innovation and wealth creation (Kirchhoff and Spencer, 2008 ). Entrepreneurial leaders and their new business models that exploit the changes in the external environment have been the key drivers of this transition. New technologies, inventions and their rate of proliferation into the masses has exponentially accelerated in the past five decades. As a result of this rapid technological change, new entrepreneurial opportunities have emerged, leading to creation of new products, new processes and new ways of servicing people’s needs (Start-up Genome Report, 2012 ). Bailetti ( 2012 ) defined technology entrepreneurship as “an investment in a project that assembles and deploys specialized individuals, heterogeneous scientific and technological knowledge-based assets for the purpose of value creation and capture for a firm”. Numerous technology-based start-ups have surfaced as entrepreneurs across the world seek to operationalize their ideas into new products and services.

India is no exception to this trend. Although still at a very nascent stage, India has emerged as the third-largest startup ecosystem in the world in terms of the number of startups (NASSCOM Start-up Report, 2019 ). India has seen a steady rise in the number of start-ups created over the past decade, with about 9000 technology-based start-ups operational in the country, growing between 12 and 15% year on year. The Indian start-up ecosystem attracted more than 390 active institutional investors who funded deals worth over $4.4 billion in just the first nine months of 2019. There are about 24 active unicorns (startups that have been assessed with a valuation exceeding USD 1 billion) operating out of India as of 2019 and the sector has created about 60,000 direct jobs and about 150,000 indirect jobs (NASSCOM Start-up Report, 2019 ).

At a macro-level, the above developments of technology-based entrepreneurship appear to be very promising. However, it is to be noted that failure rate among the technology-based start-ups is very high, and most technology-based start-ups do not see the light of the day beyond the first couple of years of operations (Certo, 2003 ; Stinchcombe, 1965 ). Ajitabh and Momaya ( 2004 ) noted that survival and success of businesses in the twenty-first century increasingly depend on their competitiveness. Prior research has observed that tech-start-ups need to deal with a lot of uncertainty across many different dimensions in their early days. Therefore, it is appropriate to assume that all the contributions that are attributed to the technology-based start-up sector emanate from those few start-ups who are able to navigate through the multiple challenges in their initial years of operation, survive and emerge successful (Bala Subrahmanya, 2017 ; Krishna, 2019 ).

The above observation brings to fore the importance of competitiveness in influencing the survival and success of technology-based start-ups. The competitiveness of a firm refers to its capacity to viably compete in a given market, leading to an increase of the firm’s market share, and subsequently make an entry into operations at international markets by way of exports, resulting in the achievement of sustainable and long-term growth and profitability (Cetindamar and Kilitcioglu, 2013 ). Wu et al. ( 2008 ) described firm-level competitiveness as the ability of the firm to optimally deploy and mobilize its assets and capabilities to derive competitive advantage in the market. The onset of COVID-19 pandemic and its aftermath resulting in nations increasingly looking to reduce external country reliance in strategic areas (Koleson, 2020 ; Viola, 2020 ) also increase the onus on how technology-based startups can help increase India’s competitiveness.

A review of extant literature indicates very little empirical research has been done to examine this phenomenon. This study aims to address this gap. By considering start-up survival as a milestone of achievement of a minimum threshold level of competitiveness, this study is conducted to identify the key factors (entrepreneur or founder-specific, firm-specific and external entrepreneurial environment-related) that inhibit or accelerate the competitiveness of technology-based start-ups operating in India.

Literature Review

Competitiveness is reviewed in prior literature as a multidimensional construct, and is generally explored as an output measure in the context of technology-based start-ups (Ajitabh and Momaya, 2004 ; Acquaah and Yasai-Ardekani, 2008 ; Singh and Gaur, 2018 . Competitiveness has been studied at three different levels—national, regional or industry and firm level. There is established literature dealing with national competitiveness and annual global competitiveness studies and reports, such as the Global Competitiveness Index (GCI) from World Economic Forum (WEF), Yearbook from International Institute for Management Development (IMD), National Competitiveness Report (NCR), from Institute of Professional Studies (IPS) are published once every 1 or 2 years to assess the same (Schwab, 2019 ; IMD, 2020; Momaya, 2019 ). Meyer-Stamer ( 2008 ) defined regional competitiveness as ‘the ability of a locality or region to generate high and rising incomes and improve livelihoods of the people living there’. Momaya ( 2001 ) described the key tenets of industrial competitiveness using the Assets, Processes and Performance model and in the process explained how certain industries contributed significantly to the competitiveness of their respective countries.

In the context of technology-based start-ups, the firm-level competitiveness has been explained as being influenced by the three dimensions namely, entrepreneurial or founder-specific, firm-specific and external entrepreneurial environment (ecosystem) related factors (Wiklund et al., 2009 ; Cader and Leatherman, 2011 ). It is therefore pertinent to examine the micro factors related to the above dimensions and comprehend the factors that influence technology-based start-ups’ competitiveness. Entrepreneurship research in its early years focused heavily on using the behavioral aspects and characteristics of the entrepreneur for studying any kind of output measures of firms, such as performance, competitiveness among others (Brockhaus, 1982 ; McClelland, 1961 ; Ronstadt, 1988 ; Storey, 1982 ). Later on, Brüderl et al. ( 1992 ) observed that the education background and credentials of the lead entrepreneur, the general and industry-specific work experience of the founders of technology-based start-ups greatly enhanced the survival of the start-ups. However, over the recent years, factors, such as prior start-up experience (Politis, 2008 ) and entrepreneurial orientation of entrepreneur (Caliendo and Kritikos, 2010 ; Wiklund et al, 2019 ), have garnered much attention. The entrepreneur’s age (Furdas and Kohn, 2011 ) has been discussed as another key factor influencing the competitiveness of technology-based start-ups.

As regards the firm-related factors influencing competitiveness of technology-based startups, Kim et al. ( 2006 ) and Criaco et al. ( 2014 ) described the benefits of human resources as being the enabler for the start-ups to address and mitigate the challenges related to funding (because highly educated entrepreneurs can relatively easily raise funds for their new venture), marketing (skilled founders can recognize the market needs better than their counterparts and therefore can create a market niche), formation of a close-knit network (on account of their higher social standing accrued due to their educational pedigree). There is unanimity in the prior literature regarding R&D investments and R&D capabilities influencing the technology-based start-up lifecycle and competitiveness (Adler et al., 2019 ; Cefis and Marsili, 2006 ).

Lloyd-Ellis and Bernhardt ( 2000 ) noted that many a times founders would complain about lack of availability and access to funding or finance mostly to cover up for their inadequacies in the technical and managerial functions of their firms. Estrin et al. ( 2006 ) and Giraudo et al., ( 2019 ) observed that financial constraints are not to be viewed as a barrier for achieving competitiveness, particularly from start-ups at their inception and survival stage. They noted that financial support was more critical to technology-based start-ups at the time of scaling up of their businesses as against in the start-up creation or survival of newly established firms.

From a perspective of external environment factors influencing competitiveness of technology-based startups, Millan et al. ( 2012 ) noted the role of government actions in ensuring the equilibrium of choice of occupation among the workforce. Cader and Leatherman ( 2011 ) deduced that sector-specific policies and conditions are more favourable to encourage survival of the technology-based firm, whereas agglomeration economies hinder the survival chances of these firms. Audretsch and Lehmann ( 2004 ) established that funding and availability of venture capital as another relevant aspect in impacting the technology-based start-up competitiveness in the pre-growth stages.

In summary, the above facets of literature review bring to fore the contribution of entrepreneur-specific, internal firm-related factors that influence the competitiveness of technology-based start-ups. Furthermore, the review indicates that certain external environment factors influence the firm-level competitiveness. Each of the above studies reviewed in the study examine the influence of individual factors on the competitiveness. It is well established that competitiveness is a multi-dimensional construct and individual factors alone cannot completely explain in entirety the phenomenon of firm-level competitiveness. Therefore, this study tries to address this gap by leveraging an integrative conceptual framework to examine firm-level competitiveness in the context of technology-based start-ups, considering start-up survival as a milestone for analysis of competitiveness.

There is growing evidence on the importance of technology-based start-ups in driving the productivity and competitiveness around the world (WEF Global Competitiveness Report, 2019). While there are some studies in examining the competitiveness of technology-based start-ups in other emerging countries (Mesquita et al., 2007 ; Acquaah et al., 2008), there is a scarcity of studies in the Indian context. India now ranks third across the globe in the number of start-ups—and therefore the lack of empirical investigation in this region deprives cross-country comparisons and hinders development of new knowledge which could benefit similar economies as India. It is for the above reason the present study assumes importance.

Two models of firm-level competitiveness have influenced the development of the conceptual framework required for the present study. Cetindamar and Kilitcioglu ( 2013 ) proposed a model of three pillars based on resource-based theory to assess firm-level competitiveness. The first pillar contained four outcome-based indicators—growth of the firm, export performance, value added and profit, and customer centricity and societal value generated. The second pillar contained input metrics (in Resource Based View (RBV) terminology) that represents the firm-specific factors, namely human resources, technology, innovation and design capabilities and financial resources. The third pillar accounted for the managerial processes and capabilities—largely a proxy for entrepreneurship and leadership characters exhibited by the senior leadership team and founders or co-founders.

Chikan ( 2008 ) proposed a generalized model to interlink and connect the national and firm competitiveness. At the national level, the output goal of the model was to increase the welfare of the citizens, while at the firm level, the output goal was to increase the productivity of firms involved in the ecosystem. Macro-level entities and factors, such as public institutions, government, macroeconomic policy and social norms, were depicted to work closely with firm-specific aspects, such as firm strategy, factor inputs, firm capabilities among others, to achieve the firm-level goal of achieving customer satisfaction with profits. The conceptual framework for the study was derived building on both of these models from the literature review.

Conceptual Framework

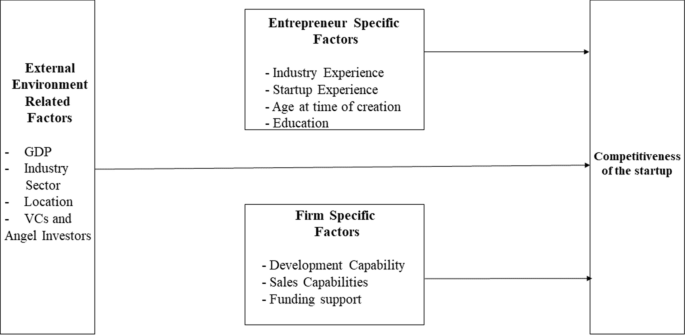

The conceptual framework used for the analysis of the data for the study is depicted in Fig. 1 .

Conceptual Framework depicting Competitiveness of Technology-based Start-ups during their pre-growth stages

The conceptual framework captures the entrepreneur-specific capabilities (individual factors), the firm-based resources and the external environment-related factors impact the technology-based start-ups competitiveness. For the entrepreneur-specific capabilities, aspects, such as entrepreneur’s age, founders’ education, entrepreneur’s prior start-up and work experience, are considered for the analysis of this study. The financial capital or resources of the firm, the R&D and sales capabilities or resources of the firm are leveraged to characterize the firm-specific factors in this study. The State Domestic Product (SDP) of the region, the number of Venture Capital (VC) deals and the presence of VCs and angel investors in the region are considered as representatives of the external environment-related factors for the purposes of analysis of this study.

Research Design

This study is based out of India from the perspective of geography and regional context. Data from technology-based start-ups that are operating in the software products or services in the information technology sector are considered for the study. This implies that technology-based start-up firms including software engineering start-ups that deal with DevOps and business operations facilitation start-ups that have an established office including headquarters in India, and that have R&D investments in India (including start-up firms that have global offices) are also considered. Further, we restrict our study to cover start-ups that started operations after the year 2005. This restriction allows us to get a good spread of start-ups that initiated operations for a reasonable period of time.

Description of Variables and Measures

The dependent variable, independent variables and control variables used for the statistical analysis are tabulated in Table 1 .

Data Description and Methods of Data Collection and Analysis

The study uses data collected from 175 Indian technology-based start-ups that are headquartered within the country for the analysis. Survival analysis (Aalen et al., 2008 ) of the data is performed using Cox proportional hazards model (Cox, 1972 ) to deduce the factors that impact the survival of the start-up and the degree to which they influence the competitiveness of the start-up. To collect data from the target audience, a questionnaire was used as the research instrument for this study. The collected data were homogenized to enable assessment across the data points. Secondary data collection was used to collect external environment-specific factors for each of the start-up in our sample.

As there is no solitary repository or database of technology-based startups in the areas chosen for the study, an aggregation of different credible data sources related to technology-based startups was made to create a master list of start-ups operating in this sector. Sources such as Indian Software Product Industry Round Table (iSPIRT) and National Association for Software and Services Companies (NASSCOM), which are the two most credible industry associations were contacted for identification of the total start-up population. Further, many government-funded incubators and corporate accelerators operating in the country were also contacted with a request to share the list of start-up firms in the country. After the aggregation and removal of redundant entries, a sanitized accurate list of start-ups was created. The authors personally administered the questionnaire in person or collected data over telephone to all the consenting founders.

To validate that the data collected from founders were representative of the population, the demographic distribution of start-ups data from the Government of India promoted Start-up India web portal ( www.startupindia.gov.in ), which is considered as a formal source of information on Indian start-ups. The comparisons were made across multiple dimensions, such as age of the technology-based start-up, distribution of start-ups with respect to their location of operations, background of the founders, in terms of their education, their start-up and industry experience among others. The results of the comparison of the start-up data from the government web portal with our data revealed that our sample was representative of the population.

Most of the data used in our study are collected using our research instrument—the questionnaire. The secondary data are collected primarily to obtain the entrepreneur profile. This information is obtained from public and professional websites, such as LinkedIn, Angel List, Facebook and similar websites. We resorted to secondary data collection for the entrepreneur profile, so that we could optimize the time during our interview to focus on the core objectives of the study.

Characteristics of the Data

A preliminary analysis on the data collected reveals that the start-ups in the sample have been operating between 6 and 69 months of time since inception. About 49% of the technology-based start-ups reported that they had achieved the milestone of survival (found their product market fit), while the remaining 51% start-ups reported that they were yet to achieve this milestone. About 90% of entrepreneurs conveyed that they had at least 1 year’s paid or industry experience prior to starting their new ventures. Further, about 63% founders indicated that they had stints in other start-ups either as founders or as employees prior to starting on their own. The range of the entrepreneurs’ age at the time of inception of the start-up firm in the sample varied from 17 to 54 years. As regards entrepreneurs’ education, about 35% of them possessed a non-engineering degree, 53% of sample had obtained an engineering bachelors’ degree and the remaining 12% had masters’ degree or higher academic or educational qualification at the time of starting up their venture.

From a firm-specific perspective, 37% of start-ups reported as not hiring any external personnel for their sales related activities, 31.5% of start-ups reported the presence of sales personnel, but with no revenues as on date of data collection, and the remainder of 31.5% indicated as generating revenue through these sales personnel. In terms of R&D capabilities of start-ups, about 18% of them reported as not hiring any external personnel for their R&D, about 66% of start-ups indicated that they had hired external personnel to pursue R&D activities, and the remaining 16% of start-ups reported as having developed a customer demonstrable prototype using their R&D personnel. In our sample, about 63% of the start-ups were not externally funded.

Results and Discussion

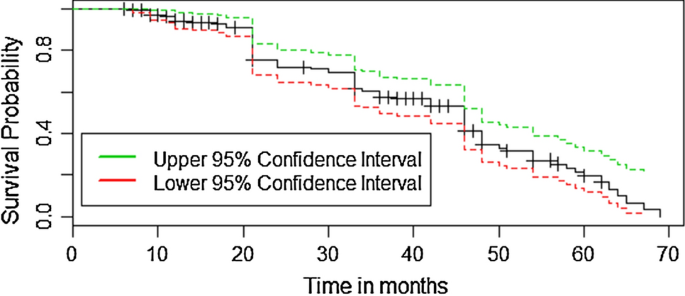

The statistical analysis of the data was initiated with a visual inspection of estimators of survival probability using non-parametric KM plots. To begin with, the survival probability and cumulative probability of survival of entire sample against time is plotted (Fig. 2 ) to understand the distribution of survival time of the start-ups. From the Fig. 2 , we can infer that after incorporation of a start-up, as time elapses, the probability of survival begins to decrease. For example, from the data in our sample a start-up has about 99% probability of survival if it is formally incorporated only in the past six months. However, if a start-up has been incorporated since four years (48 months) the probability of survival of such start-up reduces to about 50%.

Survival probability plots of start-ups

As a next step, to arrive at the right model to analyze the objectives of our study, we tried the tests of proportionality on the Cox proportional hazards model. The diagnostic results of the application of the Cox model are summarized in Table 2 . The results from Table 2 indicate that the proportionality assumption for all the independent variables does hold. The high p values for all the independent variables used in the model indicate that they are suited for usage or analysis using the Cox model. The visual evaluation of proportionality was also carried out to ensure that the Cox proportional hazards model was best suited for our analysis.

The test results of our analysis using the overall optimized model is presented in Table 3 . The test results indicate that this model fits better than the null model which indicate that the results from this model could be used for the analysis.

The results from the overall model indicate that among the entrepreneur-related factors, none of the factors has an influence on increasing the likelihood of competitiveness of technology-based start-ups in the pre-growth stages. Among the firm-specific factors, sales and R&D capabilities of the start-ups have shown to be of paramount importance in influencing the probability of survival of technology-based start-ups. Further, among the external entrepreneurial environment attributes, ‘ SDP growth’ in the region is shown to have a major impact on the competitiveness of technology-based start-ups. Following the precedent of Chandrashekar and Bala Subrahmanya ( 2017 ), the impact of the ‘ SDP growth’ attribute which is borderline significant has been discussed in the next section, although in normal circumstances this specific treatment would be avoided. The results of the analysis have important implications in the context of the lifecycle studies of technology-based start-ups and their competitiveness. From a firm-specific resources perspective, the results indicate that it is of paramount importance to have a demonstrable product offering very early in the lifecycle using which feedback could be obtained on aspects that need to be addressed before getting to product market fit. Further, the aspect of lack of revenue early on for the start-up affecting its chances of survival reinforce the findings from past literature. The external environment factors namely the SDP growth (borderline significant, from the results indicated in Table 3 ) indicate the need for a healthy macro-economic and technology-based start-up friendly ecosystem in the region, which in turn would result in enabling a higher survival rate and therefore enhanced level of competitiveness of start-ups in the region.

From these results, we also need to understand and interpret the factors which usually are attributed to influence survival and firm competitiveness—but have not come out as significant in ensuring the same. Notable among them are the entrepreneur-specific factors considered in this study.

As regards education not appearing significant in any of the models, this result can be explained on account of the information that all the founders considered in the analysis had a minimum or basic level education of a degree (graduation). Therefore, the results show that with basic minimum education, these founders are likely to exploit entrepreneurial opportunities. Similar results were noted by Yin et al. ( 2019 ) as well as by Ahn and Kim ( 2019 ) based on their assessment of performance of technology-based start-ups in Korea.

The prior start-up experience or prior industry experience of the entrepreneur has not come out as an important influence on the survival of technology-based start-ups. Prior research noted that for tasks that are well defined, repeated often, and feedback is provided in a timely and correct manner, entrepreneurial judgment can be improved (Hayward et al., 2006 ; Wright, 2001 ). In these conditions of pure uncertainty, where the range of activities and the uncertainty in pursuing every new entrepreneurial activity does not lend itself to repeatability, the aspects of prior firm start-up experience or prior industry work experience may be of little help.

From a firm-specific resources’ perspective, the aspect of funding or capitalization of the start-up does not come out as a significant factor that influences start-up competitiveness at the pre-growth stages. This result also might be viewed as contrary to existing findings, if taken at face value. This result can be explained as follows. Viewed in isolation, funding or capital infusion to a firm at any time of its lifecycle is considered a necessary factor input. In the case of technology-based start-ups, particularly in the IT sector, the nature of the industry structure is such that costs of entry for a new venture is very minimal, since there is no need to invest in any physical assets that invite capital expenditure. The only investment comes by way of intellectual and technical capital—which all of the founders of this sample possess—by way of educational pedigree.

Implications

This study makes two contributions to theory on competitiveness. First, it examines the combined impact of entrepreneurial, firm-specific and external environment-related factors on technology-based start-up competitiveness in a holistic manner. This end-to-end perspective of evaluation using a conceptual framework derived from the RBV and Assets-Processes-Performance (APP) models has enabled the verification on how, certain factors, in the presence of other influencing factors will contribute or hinder competitiveness of technology-based start-ups. Second, this study has attempted to examine firm-level competitiveness of technology-based start-ups which are in the pre-growth stages operating from an emerging economy. In doing so, it has established the applicability of the APP model to evaluate competitiveness of technology-based start-ups. It is well established that research outputs from developed economies cannot be generalized to the context of emerging economies (Boyacigiller and Adler, 1991 ). Hence, this study fills this gap by examination of factors that matter in the context of India.

For the practitioners, the results from this study indicate the need for having a strong R&D capability for technology-based start-ups to increase their probability of survival and enhanced competitiveness. Further, irrespective of whether the start-up focuses on B2B or B2C markets, the results indicate that a lean sales team with the founders or co-founders taking on the role of sales enablement would enhance the chances of start-up survival. Further, the results from our study indicates that from a macro-economic perspective, start-up survival probability increases in regions where there is good economic growth—implying that presence of an addressable market is very important for ensuring technology-based start-up competitiveness.

Limitations and Scope for Future Work

While our study has attempted to add knowledge in the scope defined for the study, a few limitations are to be noted. This study examines the phenomenon of start-up survival as a milestone for examining competitiveness, considering only one sector of the technology-based industry and in one country, and therefore the results are applicable to this limited context. Extending the scope of the study to include a couple more technology-based sectors in the same region, or a cross-country comparison of one particular sector would provide deeper insights that can be broadly applicable. Further, due to the focus on the pre-growth technology-based start-ups, only the C-Assets aspect of the competitiveness has been explored in the study. An evaluation of technology-based start-ups in growth or post-growth stages would enable a much more complete assessment of competitiveness using the entire APP framework. These suggested extensions of scope will lead to creation of new knowledge and insights related to competitiveness of technology-based start-ups.

Key Questions Reflecting Applicability in Real Life

What are the entrepreneur-specific factors that influence the firm-level competitiveness of early-stage start-ups?

What firm-specific factors impact the competitiveness of start-ups?

What are the external environment-related factors that influence the competitiveness of early-stage start-ups?

What frameworks and models can be used to assess competitiveness of start-ups that are in the pre-growth stages?

Change history

03 august 2021.

A Correction to this paper has been published: https://doi.org/10.1007/s42943-021-00030-y

Aalen, O. O., Borgan, Ø., & Gjessing, H. K. (2008). Survival and event history analysis: A process point of view . Springer-Verlag.

Book Google Scholar

Acquaah, M., & Yasai-Ardekani, M. (2008). Does the implementation of a combination competitive strategy yield incremental performance benefits? A new perspective from a transition economy in Sub-Saharan Africa. Journal of Business Research, 61 (4), 346–354

Article Google Scholar

Adler, P., Florida, R., King, K., & Mellander, C. (2019). The city and high-tech startups: The spatial organization of Schumpeterian entrepreneurship. Cities, 87 , 121–130

Ahn, S., & Kim, J. (2019). The effect of managerial characteristics on the performance of technology-based start-ups in Korea. International Journal of Global Business and Competitiveness, 14 (1), 11–23

Ajitabh, A., & Momaya, K. (2004). Competitiveness of firms: Review of theory, frameworks and models. Singapore Management Review, 26 (1), 45–61

Google Scholar

Audretsch, D. B., & Lehmann, E. E. (2004). Financing high-tech growth: The role of banks and venture capitalists. Schmalenbach Business Review, 56 (4), 340–357

Bailetti, T. (2012). Technology entrepreneurship: overview, definition, and distinctive aspects. Technology Innovation Management Review, 2 (2), 5–12

BalaSubrahmanya, M. H. (2017). Comparing the entrepreneurial ecosystems for technology start-ups in Bangalore and Hyderabad, India. Technology Innovation Management Review, 7 (7), 47–62 10th Anniversary Issue.

Boyacigiller, N., & Adler, N. J. (1991). The parochial dinosaur: Organizational science in a global context. Academy of Management Review, 16 , 262–290

Brockhaus, R. H. (1982). The psychology of the entrepreneur. In C. A. Kent, D. L. Sexton, & K. H. Vesper (Eds.), Encyclopedia of Entrepreneurship. (pp. 39–56). Prentice-Hall.

Brüderl, J., Preisendörfer, P., & Ziegler, R. (1992). Survival chances of newly founded business organizations. American Sociological Review, 57 , 227–242

Cader, A. H., & Leatherman, C. J. (2011). Small business survival and sample selection bias. Small Business Economics, 37 , 155–165

Caliendo, M., & Kritikos, A. S. (2010). Start-ups by the unemployed: characteristics, survival and direct employment effects. Small Business Economics, 35 , 71–92

Cefis, E., & Marsili, O. (2006). Survivor: The role of innovation in firms’ survival. Research Policy, 35 (5), 626–641

Certo, S. T. (2003). Influencing initial public offering investors with prestige: Signaling with board structures. Academy of Management Review, 28 (3), 432–446

Cetindamar, D., & Kilitcioglu, H. (2013). Measuring the competitiveness of a firm for an award system. Competitiveness Review: An International Business Journal, 23 (1), 7–22

Chandrashekar, D., & BalaSubrahmanya, M. H. (2017). Absorptive capacity as a determinant of innovation in SMEs: A study of Bengaluru high-tech manufacturing cluster. Small Enterprise Research, 24 (3), 290–315

Chikán, A. (2008). National and firm competitiveness: a general research model. Competitiveness Review: An International Business Journal, 18 (1–2), 20–28

Cox, D. R. (1972). Regression models and life-tables. Journal of the Royal Statistical Society: Series B (Methodological), 34 (2), 187–202

Criaco, G., Minola, T., Migliorini, P., & Serarols-Tarrés, C. (2014). To have and have not: Founders’ human capital and university start-up survival. The Journal of Technology Transfer, 39 (4), 567–593

Estrin, S., Meyer, K. E., & Bytchkova, M. (2006). Entrepreneurship in transition economies. In M. Casson, B. Yeung, A. Basu, & N. Wadeson (Eds.), The Oxford handbook of entrepreneurship. Oxford University Press.

Furdas, M., Kohn, K. (2011). Why is startup survival lower among necessity entrepreneurs? A decomposition approach . Preliminary Version, April 2011.

Giraudo, E., Giudici, G., & Grilli, L. (2019). Entrepreneurship policy and the financing of young innovative companies: Evidence from the Italian Startup Act. Research Policy, 48 (9), 103801

Hayward, M. L. A., Shepherd, D. A., & Griffin, D. (2006). A hubris theory of entrepreneurship. Management Science, 52 (2), 160–172

Kim, P. H., Aldrich, H. E., & Keister, L. A. (2006). Access (Not) denied: The impact of financial, human and cultural capital on entrepreneurial entry in the United States. Small Business Economics, 27 , 5–22

Kirchhoff, B. A., & Spencer, A. (2008). New High Tech Firm Contributions to Economic Growth. Proceedings of international council for small business world conference, 2008 . Halifax.

Koleson, J. (2020). TikTok is on the clock, will democracy stop?

Krishna, H. S. (2019). High-tech internet start-ups in India . Cambridge University Press.

Lloyd-Ellis, H., & Bernhardt, D. (2000). Enterprise, inequality and economic development. Review of Economic Studies, 67 , 147–168

McClelland, D. C. (1961). The Achieving Society . Van Nostrand.

Mesquita, L., Lazzarini, S. G., & Cronin, P. (2007). Determinants of firm competitiveness in Latin American emerging economies: Evidence from Brazil’s auto-parts industry. International Journal of Operations and Production Management, 27 (5), 501–523

Meyer-Stamer, J. (2008). Systematic competitiveness and local economic development discussion paper . Mesopartner.

Millán, J. M., Congregado, E., & Román, C. (2012). Determinants of self-employment survival in Europe. Small Business Economics, 38 (2), 231–258

Momaya, K. (2001). International competitiveness: Evaluation and enhancement . Hindustan Publishing Corporation.

Momaya, K. S. (2019). The past and the future of competitiveness research: A review in an emerging context of innovation and EMNEs. International Journal of Global Business and Competitiveness , 14 (1), 1–10. https://doi.org/10.1007/s42943-019-00002-3 .

NASSCOM Start-up Report. (2019). Indian Tech Start-up Ecosystem—Leading Tech in the 20s.

Politis, D. (2008). Does prior start-up experience matter for entrepreneurs’ learning? Journal of Small Business and Enterprise Development, 15 , 472–489

Ronstadt, R. (1988). The corridor principle. Journal of Small Business Venturing, 3 (1), 31–40

Schwab, K. (2019). The global competitiveness report 2019 . World Economic Forum.

Singh, S. K., & Gaur, S. S. (2018). Entrepreneurship and innovation management in emerging economies. Management Decision., 56 (1), 2–5

Start-up Genome. (2012). Start-up Ecosystem Report 2012 , USA.

Stinchcombe, A. L. (1965). Social structure and organizations. In J. G. March (Ed.), Handbook of organization. (pp. 142–193). Rand McNally.

Storey, D. J. (1982). Entrepreneurship and the new firm . Beckenham.

Viola, L. A. (2020). US strategies of institutional adaptation in the face of hegemonic decline. Global Policy, 11 , 28–39

Wiklund, J., Nikolaev, B., Shir, N., Foo, M. D., & Bradley, S. (2019). Entrepreneurship and well-being: Past, present, and future. Journal of Business Venturing, 34 (4), 579–588

Wiklund, J., Patzelt, H., & Shepherd, D. A. (2009). Building an integrative model of small business growth. Small Business Economics, 32 , 351–374

Wright, W. F. (2001). Task experience as a predictor of superior loan loss judgments. Auditing, 20 (1), 147–156

Wu, L. Y., Wang, C. J., Chen, C. P., & Pan, L. Y. (2008). Internal resources, external network, and competitiveness during the growth stage: A study of Taiwanese high–tech ventures. Entrepreneurship Theory and practice, 32 (3), 529–549

Yin, W., Moon, H. C., & Lee, Y. W. (2019). The success factors of Korean global start-ups in the digital sectors through internationalization. International Journal of Global Business and Competitiveness , 14 (1), 42–53. https://doi.org/10.1007/s42943-019-00003-2

Download references

Acknowledgements

The authors gratefully acknowledge and thank all the anonymous reviewers and the editors, and the Editor-in-Chief Kirankumar S. Momaya in particular for their valuable and detailed feedback which has enabled the authors to significantly improve the quality of the paper.

An earlier version of this paper was presented at the IIMB-SJSU International Conference on Transnational Entrepreneurs and International SMEs in Emerging Economies: Drivers and Strategies, organized by Indian Institute of Management Bangalore (IIMB), India, in collaboration with San José State University (SJSU), California, USA, held at Indian Institute of Management Bangalore, India from May 20–22, 2015.

Author information

Authors and affiliations.

Indian Institute of Management Bangalore, Bangalore, India

Deepak Chandrashekar

Department of Management Studies, Indian Institute of Science, Bengaluru, India

Bala Subrahmanya Mungila Hillemane

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Deepak Chandrashekar .

Ethics declarations

Conflict of interest.

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

This article was published online first on 17 May 2021 with a wrong file as Supplementary Information. This has now been corrected.

Supplementary Information

Below is the link to the electronic supplementary material.

Supplementary file1 (PDF 128 KB)

Rights and permissions.

Reprints and permissions

About this article

Satyanarayana, K., Chandrashekar, D. & Mungila Hillemane, B.S. An Assessment of Competitiveness of Technology-Based Startups in India. JGBC 16 , 28–38 (2021). https://doi.org/10.1007/s42943-021-00023-x

Download citation

Received : 19 November 2020

Accepted : 19 April 2021

Published : 17 May 2021

Issue Date : June 2021

DOI : https://doi.org/10.1007/s42943-021-00023-x

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Start-up competitiveness

- High-tech start-ups

- Technology-based start-ups

- Find a journal

- Publish with us

- Track your research

A business journal from the Wharton School of the University of Pennsylvania

Three Waves: Tracking the Evolution of India’s Startups

November 5, 2019 • 15 min read.

How did India’s innovation ecosystem evolve and reach its current position? The authors of this opinion piece share their insights.

- Entrepreneurship

Entrepreneurship is embedded in India’s economy and culture. This opinion piece traces the roots of India’s startup ecosystem and where it is headed in the future. The co-authors include Somshubhro Pal Choudhury, a partner at Bharat Innovation Fund , a $100 million venture fund that backs entrepreneurs building deep-tech companies in India; Supriya Sharma, partner – insights at CIIE.CO , a leading entrepreneurship center based at the Indian Institute of Management – Ahmedabad; and Sanjay Jain, a partner at Bharat Innovation Fund.

India’s startup economy has been booming. The last decade has seen significant activity on multiple fronts including the founding of new startups, amount of funding and number of investment rounds, influx of global investors and startups, development of regulatory infrastructure, global mergers and acquisitions, and internationalization. Entrepreneurial success stories abound. At last count, India had 26 unicorns , with eight new entrants joining the club in 2018 alone.

For example, consider Byju’s, one of the newly minted unicorns in the K-12 online education space, which today has a valuation of $5.5 billion. Started in 2011 by a former schoolteacher, Byju’s has gone through more than seven rounds of funding, acquired a customer base of some 35 million subscribers, and is already profitable. The company had revenues of more than $200 million in 2018, with a three-fold jump over the previous year and a target of doubling revenues this year. Byju’s recently acquired Bay Area-based early learning phygital (physical plus digital) platform startup, Osmo, for $120 million. Byju’s also partnered with Walt Disney Inc. for its aggressive global expansion into the early learning space with Disney’s timeless stories and characters.

Amid all this fervor, it is important to take a step back and reflect on how the Indian startup ecosystem has reached its current position. History repeats itself, they say, but our intentions lean more towards understanding the patterns of evolution. That can help us equip ourselves and create interventions to keep the momentum going.

Like most old economies and cultures, entrepreneurship and trade have blossomed in India for centuries. Built on these foundations, India’s current entrepreneurial ecosystem is a result of three waves of entrepreneurial activity with distinct focus areas – Information Technology (IT), consumerism and innovation. In our view, each of these waves is marked by distinct kinds of businesses, predominant activities and ecosystems comprising various social, regulatory, technological, economic and cultural elements. While each wave draws upon the previous one, we find that it is distinct from its predecessor and successor.

We will elaborate upon these waves, but only after touching upon the foundations of entrepreneurship in India. After all, we must begin at the beginning (or as far back as we can go).

Of Oceans, Seas and Risk Takers

Culturally, many communities in India are believed to be entrepreneurial and avid risk takers. Historically, Indian traders are known to have travelled as far as Egypt, Bahrain, Vietnam and Burma (Myanmar), among other countries. Entrepreneurial communities in India own and run many family-owned small- and medium-sized businesses as well as large behemoths such as Reliance and Bajaj. A report published in 2018 notes that 111 of the most popular family-owned businesses had a total market capitalization of some $839 billion. This number does not include the vast number of small and medium-sized family-owned businesses spread across India.

“At last count, India had 26 unicorns, with eight new entrants joining the club in 2018 alone.”

Plenty of data support these entrepreneurial inclinations. The Global Entrepreneurship Monitor estimates some 20% of Indians (aged between 18 and 64 years) intend to start a business in the next three years, while more than 11% are nascent entrepreneurs (against the global average of 12.6%). About 63.7% of people in India consider entrepreneurship to be a desirable career choice, against the global average of 62.4%.

A stroll along the streets of the old cities of Ahmedabad, Kolkata, Mumbai, Delhi, Hyderabad (and many others) or a drive through the industrial clusters spread all over the country reveals the entrepreneurial spirit embedded in the cultural and economic milieu of India. These embedded entrepreneurial inclinations, we believe, have laid the foundations for waves of entrepreneurial activity in India.

Wave 1: IT Matters

The roots of information technology can be seen in the setting up of schools of technology and management and entry of IBM in India in 1950s (only to exit two decades later). In 1968, the corporate giant, Tata Group, set up Tata Consultancy Services and took on several computerization related projects in India. It partnered with a U.S. based mainframe-manufacturing company and thus began the era of offshoring.

However, the wave of IT and IT-enabled services began taking cognizable form with the founding of companies like Patni Systems around the 1980s. Founders of these companies were educated in prestigious schools (mainly in the U.S.) and closely witnessed the market asymmetries to realize the unlocked value in offshoring. They returned home to set up IT businesses to capture this value. These IT companies also became nurturing grounds for entrepreneurs. Early employees of such companies went on to establish giants like Infosys, many of which, in turn, became breeding grounds for the next generation of entrepreneurs.

The growth of these IT companies and increased offshoring of R&D created a pull on technical education. As a result, engineering became the almost de facto choice for higher education, thus leading to the creation of a large pool of engineers. In 2014, India was estimated to be home to some 25% of the world’s engineering graduates .

With almost a non-existent venture funding industry back then, most of these businesses in the first wave were bootstrapped and they focused on services. Stories are often told of N. R. Narayana Murthy, founder of Infosys, borrowing money from his spouse and being continually broke. Such was the entrepreneurial zeal and the size of the offshoring opportunity that many IT businesses established in the 1990s have now grown into some of the largest and most successful companies founded in India. Today, India’s IT/ITES and BPO firms constitute a $180 billion industry primarily focused on the global market.

The success of Indian IT businesses also brought more prosperity to the country’s middle class. Between the 1960s and 1990s, a typical middle-income household had one primary earner who was either employed by the government or a public sector undertaking or ran a small local business. Children’s education was taken seriously and they were often guided towards engineering or medical schools. Once they had graduated, engineers found immediate employment with IT companies (through campus placement) and brought home salaries that were higher than their parents’ incomes. As IT businesses grew, so did the paychecks of their employees, the effects of which also spilled over to other industries.

Since more money was now available to be spent, the Indian economy opened up to global markets, creating more avenues for consumption and setting in motion the next wave of entrepreneurship.

Wave 2: Rise of Consumerism

The Indian consumer story was sparked by an increase in expendable income. This wave started around the middle of the last decade and created opportunities for a variety of business models.

With the liberalization of policy infrastructure, more capital was now becoming available. The investment thesis — a growing emerging middle class with higher incomes would consume more, use smartphones and access the internet often. Internet usage was expected to become cheaper, therefore improving access. Thus, models around e-commerce, specialized retail, marketplaces, hyper-delivery networks and organizing the unorganized sector were being bet upon.

This was a mammoth wave of entrepreneurial activity in India; the ‘startup’ expectations were also seen to have taken birth around this wave. Substantial investments around the consumer investment thesis first came from the U.S., later followed by China and Japan. Unparalleled opportunities were created; these not only led to the India foray of large consumer brands like Amazon and Uber, but also the emergence of more than 25 home-grown unicorns (like Ola, Zomato, Swiggy, PayTM and many more). Not to forget, Walmart acquired Flipkart at a valuation of $22 billion.

This wave is also marked by many me-too platforms and aggregator models, albeit with business model innovations and adapting processes to India’s unique culture and demands like ‘cash-on-delivery.’ Quite unlike their Chinese counterparts that have enjoyed a near monopolistic luxury, these Indian born ventures are competing strongly in an open market against global, well-funded, and well-matured competitors. Some of the ventures have succumbed but several have succeeded and are now setting their eyes on global expansion.

“India has evolved from being the IT, services and business process outsourcing hub of the world to being a significant R&D center for multinationals and many Silicon Valley startups.”

Wave 3: Up the Innovation Curve

The latest wave in India has two defining characteristics — B2B models and deep-tech, IP-driven innovation.

Over the last two decades, India has evolved from being the IT, services and business process outsourcing hub of the world to being a significant R&D center for multinationals and many Silicon Valley startups. Bangalore, particularly, has emerged to be the capital of GCC or Global Capability Centers, with about half of the global 1200 multinationals having set up their R&D centers in India. Today, we see entire product lines and unique products being designed, developed and delivered entirely from India. A few multinationals including GE, Cisco and Adobe have even shifted the P&L of some of their R&D business units to India.

Some may say that India’s R&D story began with Texas Instruments setting up their R&D center in Bangalore in 1985. However, we find that the R&D activity in the ecosystem accelerated significantly from the late-1990s, perhaps linked to the opening up of the Indian economy and the foundations created by the first wave of IT businesses. While these offshore-R&D development centers started off with basic testing, product maintenance and some rudimentary software development, many of them significantly went up the value curve over the next two decades. This led to many global multinationals setting up their second largest R&D sites beyond their headquarters.

Closely clued into the global ecosystems, Indian startups are moving up the intellectual property ladder, too. We are seeing fewer ‘me-too’ e-commerce models and more startups building unique products and solutions. The target customer is no longer only (or primarily) India and an increasing number of startups in India are now born global. These entrepreneurs are more seasoned, with experience of having worked in large multinationals, and have a global exposure with working in the U.S. or Europe before returning to India. Most importantly, these entrepreneurs have a product mindset unlike their counterparts from the previous generation who were more services focused. These entrepreneurs are building from India, for the world. Playing in the global market also brings home strong IP sensibilities for the ecosystem.

The other characterizing feature of the current wave is the salience of B2B models. The growth of the IT businesses from the first wave and the consumer-driven startups from the second wave along with the drive for traditional businesses to compete on a global playing field has created opportunities for business (as against consumer) products and solutions. The demand for B2B solutions from the global markets is a few times over. Many of us would have heard startups shying away from B2B models often citing the difficult working relationships. This is beginning to change with businesses that were themselves struggling startups in the recent past, now creating a more encouraging market for other young B2B startups.

The mass consumer segment from the second wave appears to be hyper-invested now with winners already picked, but there are several niche opportunities that are getting capitalized. Beyond the current unicorns, the next wave of 100 startups in India are much more diverse, going beyond consumer to B2B marketplaces, healthtech, enterprise-tech, robotics, fintech and many more. Some of these startups include Grey Orange Robotics, Medgenome, Blackbuck, Bankbazaar, Uniphore, etc.

The startup ecosystem is now shifting to more B2B models that have deep-tech and IP-driven innovation at their core. Examples include some of the startups in our Bharat Innovation Fund portfolio including Entropik Technologies (platform for Emotion AI, mapping EEG brainwave signals, facial expression and eye tracking), Detect Technologies (high temperature magneto-resistive sensor and signal processing for leakage and corrosion detection in oil refineries) and even a number of new-age Space-tech startups building affordable connectivity solutions, nano-satellite platforms and 3D printed modular rocket engines, taking a cue on the affordable Space-tech success from Indian Space and Research Organization (ISRO). There are now multiple success stories with Zoho and Freshworks leading the unicorn SaaS space from the southern city of Chennai. We now see over 500 AI startups in India leveraging the affordable talent and easier access to large pools of data and as well as a number of in-house and outsourced data science teams offering services to global customers.

While a plethora of challenges remain, most startups in the current wave seem to be adopting the Israeli way of establishing a global connect and customer base for scaling-up, after development, piloting and achieving product-market fit, done affordably in India in comparison to their global counterparts.

“These entrepreneurs are building from India, for the world.”

The Digital India Push

Digital India has been a big initiative by the Indian Government over the past decade across political party lines. The push towards this started with the development of public goods digital infrastructure known as ‘IndiaStack’ in 2009 and issuance of biometric IDs to Indians. IndiaStack is a presence-less, cashless, paperless, consent-based scalable architecture that promises to revolutionize and accelerate India’s digital push. It promises to enable the country leapfrog from being a digital infrastructure poor country to being a leader. In the last eight years, over 1.2 billion Indians have received their biometric IDs — Aadhaar — and onboarded on the Universal IDentification (UiD) project. This was the fastest ever rate of reaching a billion users, surpassing the growth of giants like Facebook, WhatsApp or even mobile phones!

The IndiaStack infrastructure seems to have enabled a more efficient opening of over 500 million bank accounts for citizens who never had one earlier. These bank accounts were opened with an aim to ease citizens’ access to formal credit and direct transfer of government benefits and subsidies. This IndiaStack infrastructure has also made its presence felt in the private sector with the country moving fast from largely an all-cash economy to cashless digital transactions.

Additional infrastructure layers are being built on IndiaStack. For instance, ‘HealthStack’ aims to enable India’s flagship healthcare scheme of insurance to 300 million citizens and ‘Digital Sky’ focuses on drone and small aeroplane flight plan authorization. A uniform single taxation scheme, launched recently, for the entire country has increased the tax net significantly and simplified the age-old taxation norms that have plagued the growth rate for decades. Infrastructure is ready for every citizen to have a Digital Locker for e-signed documents like driving license and certifications. India’s digital infrastructure is also attracting considerable interest from countries that are on the path of deeper digitization.

Riding on the above three waves and the government’s push for digitization, India’s startup ecosystem now stands firmly with over 300 incubators and accelerators, about 30,000 active startups. In 2018, institutional venture funding of over $4 billion channeled towards tech startups only speaks of the growing size of this ecosystem. With over 50 central and state government policies for supporting startups, the rails of policy and regulation are also getting stronger in India. The recent thrust on building technological infrastructure and enhancing the ease of business is further fuelling the growth of the ecosystem. While economic challenges remain, we are positive about the strong political will and the promise of bold reforms for the long run to get the economy to $5 trillion.

As 2019 flies by, we are closely witnessing the evolution of the third wave. We are seeing startups apply Artificial Intelligence and Machine Learning to create solutions across sectors. Novel use cases of IoT, blockchain and the IndiaStack are also emerging. We are seeing startups that are born global, creating solutions for the world as well as those that are applying next-gen technology to address deep and complex challenges of inclusion and livelihoods in India. The future holds immense promise and we are humbly contributing to its creation.

More From Knowledge at Wharton

Why Do So Many EV Startups Fail?

Do Accelerators Improve Startup Success Rates?

Can Intrapreneurship Help Close the Racial Wealth Gap?

Looking for more insights.

Sign up to stay informed about our latest article releases.

- My Shodhganga

- Receive email updates

- Edit Profile

Shodhganga : a reservoir of Indian theses @ INFLIBNET

- Shodhganga@INFLIBNET

- University of Mysore

- Department of Commerce

Items in Shodhganga are licensed under Creative Commons Licence Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0).

Essay on Startups in India

Students are often asked to write an essay on Startups in India in their schools and colleges. And if you’re also looking for the same, we have created 100-word, 250-word, and 500-word essays on the topic.

Let’s take a look…

100 Words Essay on Startups in India

Introduction.

Startups in India are businesses that are in their initial stage. They are usually small but have big dreams to grow and succeed.

Significance

Startups play a significant role in India’s economy. They create job opportunities and contribute to economic growth.

However, startups face many challenges. They often struggle with funding, market competition, and lack of experience.

The Indian government supports startups through various initiatives. They provide funding, mentorship, and resources to help them grow.

In conclusion, startups in India are shaping the future of the country. They are driving innovation and economic growth.

Also check:

- Speech on Startups in India

250 Words Essay on Startups in India

The emergence of startups in india.

India, with its vast consumer market and tech-savvy population, has become a fertile ground for startups. The emergence of startups in India is a testament to the nation’s entrepreneurial spirit, driven by factors such as governmental support, availability of capital, and a vibrant ecosystem of incubators and accelerators.

Role of Government and Policy Framework

The Indian government’s ‘Startup India’ initiative, launched in 2016, has been instrumental in fostering a conducive environment for startups. The policy framework includes tax exemptions, easier compliance, and a fund of funds, which have collectively boosted the startup culture.

Access to Capital

Startups in India are increasingly gaining access to capital, with venture capitalists and angel investors showing keen interest. Moreover, the rise of crowdfunding platforms has democratized funding, allowing startups to raise capital from a wide range of investors.

Challenges and Opportunities

Despite the favorable conditions, startups in India face challenges such as regulatory hurdles, market uncertainties, and talent acquisition. However, these challenges also present opportunities for startups to innovate and disrupt traditional business models.

The Road Ahead

The future of startups in India looks promising, with the country poised to become the third-largest startup ecosystem globally. As the digital economy expands, startups will play a pivotal role in driving innovation, creating jobs, and contributing to India’s economic growth.

In conclusion, startups in India are at the cusp of a revolution, fueled by supportive policies, access to capital, and a dynamic entrepreneurial ecosystem. The challenges they face will only serve to spur innovation and resilience, shaping the future of the Indian economy.

500 Words Essay on Startups in India

Introduction to startups in india.

The Indian startup ecosystem is a vibrant, dynamic landscape, teeming with innovative ideas and ambitious entrepreneurs. The past decade has witnessed a significant rise in entrepreneurial activity, facilitated by factors such as favorable government policies, increased access to capital, and the rapid proliferation of digital technology.

The Evolution of the Startup Ecosystem

The startup culture in India has its roots in the early 2000s, with the IT and ITES sectors pioneering the trend. However, it was not until the late 2000s that this culture started gaining momentum. The launch of Flipkart in 2007, widely considered India’s first successful startup, marked a turning point. Since then, the ecosystem has evolved rapidly, with sectors like e-commerce, fintech, edtech, and healthtech emerging as popular startup domains.

Government Initiatives and Policy Support

The Indian government has played a pivotal role in fostering the startup culture. The launch of the ‘Startup India’ initiative in 2016 was a significant milestone. This initiative aimed to build a strong ecosystem for nurturing innovation and startups, driving sustainable economic growth, and generating large scale employment opportunities. The government has also introduced several tax and fiscal incentives to encourage startups, including a three-year tax holiday and a fast-track patent regime.

Investment Climate and Funding

The investment climate in India has been largely favorable for startups. Venture capital firms, angel investors, and even corporates have shown a keen interest in investing in Indian startups. The rise of unicorns (startups valued at over $1 billion) like Paytm, Ola, and Zomato is a testament to the robust investment environment. However, the funding landscape is not without its challenges. Many startups face difficulties in raising early-stage funding, and there is a need for more structured support in this area.

Challenges and the Way Forward

Despite the promising growth, the Indian startup ecosystem faces several challenges. Regulatory hurdles, lack of skilled manpower, and difficulties in scaling up are some of the key issues. Moreover, the failure rate of startups is high, underscoring the need for more robust business models and better mentorship.

Looking ahead, the focus should be on creating a more conducive environment for startups. This includes easing regulatory norms, enhancing access to early-stage funding, and fostering a culture of innovation and risk-taking.

The Indian startup ecosystem, while still in its nascent stages, is showing immense potential. With the right support and nurturing, it can serve as a powerful engine for economic growth and job creation. The journey of startups in India is not just about creating unicorns. It is about fostering a culture of innovation, entrepreneurship, and risk-taking, which can drive India towards a more prosperous and sustainable future.

That’s it! I hope the essay helped you.

If you’re looking for more, here are essays on other interesting topics:

- Essay on Social Movements in India

- Essay on School Safety in India

- Essay on Role of Science in Make in India

Apart from these, you can look at all the essays by clicking here .

Happy studying!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Mandarin - China

- Mandarin-Taiwan

Google Translate – an automatic translation service that uses state-of-the-art technology, not human translators, to translate text – provides instant translations in different languages. By providing these translations, we hope to make essential information available to a diverse range of investors. However, please be aware that, since translations are done by machine, they may not always be perfect. Please see our disclaimer at the bottom of this page.

We provide this link to Google Translate as a courtesy to visitors. We do not own, manage or control any aspect of Google Translate and are not responsible for the translations provided by Google Translate. We do not make any promises, assurances, or guarantees as to the accuracy, reliability, or timeliness of the translations provided. We can only verify the validity and accuracy of the information provided in English. Viewers who rely on information through Google Translate on our website do so at their own risk. We shall not be liable for any inaccuracies or errors in the translation and shall not accept liability for any loss, damage, or other problem, including without limitation, indirect or consequential loss or damage arising from or in connection with use of the Google Translate Service. By using Google Translate, you understand and agree to this disclaimer. If there are any concerns regarding the accuracy of the information presented within the translated versions of our site, please refer back to the official English language website.

- fdi policy ,

- taxation in india ,

- major investors

- The Indian Unicorn Landscape

Startup Ecosystem in India

India has emerged as the 3rd largest ecosystem for startups globally with over 1,12,718 DPIIT-recognized startups across 763 districts of the country as of 03rd October 2023. India ranks #2nd in innovation quality with top positions in the quality of scientific publications and the quality of its universities among middle-income economies. The innovation in India is not just limited to certain sectors. We have recognized startups solving problems in 56 diverse industrial sectors with 13% from IT services, 9% healthcare and life sciences, 7% education, 5% agriculture and 5% food & beverages.

Indian Startup Ecosystem has seen exponential growth in past few years (2015-2022):

- 15X increase in the total fun ding of startups

- 9X increase in the number of investors

- 7X increase in the number of incubators

The Indian Unicorns are flourishing in the fast-paced and dynamic economy of today. These startups are not only developing innovative solutions and technologies but are generating large-scale employment. Till FY 2016-17, approximately one unicorn was being added every year. Over the past four years (since FY 2017-18), this number has been increasing exponentially, with a whopping 66% Year-on-Year growth in the number of additional unicorns being added every year. As of 03rd October 2023, India is home to 111 unicorns with a total valuation of $ 349.67 Bn. Out of the total number of unicorns, 45 unicorns with a total valuation of $ 102.30 Bn were born in 2021 and 22 unicorns with a total valuation of $ 29.20 Bn were born in 2022. 2023 saw the emergence of Zepto as the latest and only unicorn in the year.

Unicorn Elements

- What is a unicorn? Unicorn is a term used in the venture capital industry to describe a privately held startup company with a value of over $1 billion.

- What triggered the unicorn rush during 2021? While work from home during the pandemic fueled the growth of digital businesses in India, the incident also resulted in a long unicorn list. Mainly three factors, a thriving digital payments ecosystem, large smartphone user base and digital-first business models, have come together to attract investors. Tech companies, which have become household brands, are contributing to the unicorn boom in India, as smartphone penetration and digitization of commerce in every aspect of life has increased manifold during the pandemic. Besides fintech, e-commerce grocery, SaaS and marketplace players are contributing the most to the unicorn universe.

Unicorns Of India

As of 03rd October 2023, India is home to 111 unicorns with a total valuation of $349.67 Bn.

The year 2021, 2020, and 2019 saw the birth of the maximum number of Indian unicorns with 45, 11, and 7 unicorns coming each year, respectively. COVID-19 has caused a great amount of socio-economic suffering globally, but it is during this time when the resilient Indian Entrepreneurs have worked effortlessly to not only contribute to the economy but to also contribute toward COVID-19 relief efforts. In 2020, we witnessed the birth of more than 10 unicorns. ‘Its raining unicorn’ has been the motto of the year 2021 with 45 unicorns pumped in the ecosystem and many soonicorns waiting in line.

Geographically, the center of India's high-tech industry, Bengaluru is India’s unicorn capital with the largest number of unicorns headquarters followed by Delhi (NCR) and Mumbai. While we see unicorns active in Tier I cities, this ecosystem is not restricted and is proliferating across the country till the last district. Traditional sectors such as E-commerce, Fin-tech, E-commerce, Supply Chain & Logistics, Internet Software & Services do dominate the arena but a strong wave of unconventional sectors such as Content, Gaming, Hospitality, Data management & analytics, etc are making their place on the list.

While every startup has its unique journey to becoming a unicorn, the minimum and maximum time taken by a startup to become a unicorn are 6 months and 26 years, respectively. Mensa Brands took only 6 months to become a unicorn in 2021, making it one of fastest unicorns in Asia.

Indian Startups turned Unicorns in 2021

In 2021 itself, India witnessed the birth of 45 unicorns with a total valuation of $102.30 Bn. Bengaluru, Delhi NCR, and Mumbai continue to be the top cities preferred as unicorn headquarters in 2021. Unconventional sectors and sub-sectors marked an entry into the unicorn space including, NBFCs, Conversational Messaging, Cryptocurrency Exchanges, D2C, Cloud Kitchens and many others.

Indian unicorns are also exploring the public listing avenues as a next step to realise the growth potential. Some one of big unicorn names that offered an IPO include Zomato, Nykaa, PolicyBazaar, Paytm and Freshworks, while many are already in line such as Delhivery, Mobikwik and CarDekho.

Today, 1 out every 10 unicorns globally have been born in India. Overall, 2021 is experienced an exponential boom when it comes to startups entering the unicorn club. This is a testament to the vibrant startup ecosystem present in India.

2022 has witnessed the birth of 22 unicorns with a total valuation of $ 29.2 Bn while only one unicorn has emerged in 2023 with a valuation of $ 1.4 Bn (as of 03rd October 2023).

Investors in Unicorns

The robust nature of the Indian startup ecosystem is evident in 2022 year-to-date when, as per a YourStory Report2, in H1 2022 891 funding deals were recorded, 82.8% higher in comparison to H1 2021 (541 deals). Over $ 17 Bn funding was raised by startups, 1.8x of funding raised in H1 2021 ($ 9.4 Bn). Sequoia Capital India has been the most active investor, followed by Tiger Global Management, Kunal Shah (Founder, CRED), Better Capital, Inflection Point Ventures, LetsVenture, Accel, Blume Ventures, 9Unicorns, and Alpha Wave Global.

Leading sectors inviting funding include FinTech, EdTech, Ecommerce, Social Network,FoodTech, Logistics and Supply Chain, Media and Entertainment, D2C Brands, SaaS, and HealthTech. FinTech, EdTech and Ecommerce accounted for 19.7, 9.4 and 6.2 percent of total funding.

Additionally, there also has been a shift in the traditional way of funding, wherein startups are now looking at exercising alternate routes such as crowdfunding, revenue-based financing, venture debt, bank loans, etc. Startups such as Zerodha, which have been bootstrapping since inception are changing the unicorn funding norms and promoting independence and revenue generation since the early stages. Since the onset of COVID-19, an unconventional trend observed is the new entries to the unicorn club without any billion-dollar ticket size investment.

Unicorn Sector Snaps

- The HealthTech market in India is estimated reach $ 5 Bn by 2023, growing at a CAGR of 39% post the pandemic impact. Digital shift, use of better technology, and favourable government policies are facilitating the growth of the market.

- Noida-based healthtech startup Innovaccer has become the first Indian unicorn in the healthcare sector currently valued at $ 1.3 Bn. Innovaccer analyses healthcare data to provide actionable insights to healthcare providers, hospitals, insurance companies and other organisations and businesses.

- Earlier this year, Pharmeasy, an online pharmacy and diagnostics brand, became a unicorn, bagging a valuation close to $ 1.5 Bn. The online pharmacy is now planning to go public soon, eyeing a valuation of about $ 7 Bn through its IPO.

- Tata 1mg, Cure.fit and Pristyn Care have joined the unicorn club bringing the total number of Healthcare unicorns to 5 with a total valuation of $ 12.79 Bn

- The heathcare segment in India is soon to see added number of unicorns with the growth of health-tech startups such as Practo, HealthifyMe etc.

Social Commerce

- Social commerce startups in India have generated revenue worth of $554 million as of July 2021, a 7x increase from last year and the highest ever since 2015.

- Social commerce has made it possible to unlock tier 2 and tier 3 markets and reach low-margin categories in fast-moving consumer goods and groceries, which large e-commerce platforms have not done so far, helping boost the overall e-commerce industry, experts and investors who view the sector as an extension of e-commerce.

- Meesho, backed by Facebook, has become the first Indian social commerce startup to enter the unicorn club valued at $ 2.1 Bn. Meesho is an online reseller network for individuals and small and medium businesses (SMBs), who sell products within their network on social channels such as WhatsApp, Facebook, and Instagram. It has about 13 Mn individual entrepreneurs, bringing the ecommerce benefits to 45 Mn customers pan India. Meesho claims to have delivered orders from more than 100K registered suppliers to over 26K pin codes across 4,800 cities, generating over INR 500 Cr ($68 Mn at current conversion rate) in income for individual entrepreneurs

- The social commerce segment in India is fast growing, with companies like SimSim, GlowRoad, CityMall and Bulbul also in the unicorn race, getting attention from both customers and investors.

Next Stage: Going Beyond the Unicorn

The global startup ecosystem is witnessing a shift as the world is increasingly realising the potential carried by the startups. We are gradually transitioning from the age of unicorns to the age of decacorns.

A decacorn is company that has attained a valuation of more than $ 10 Bn.

As of 03rd October 2023, 55 companies, 56 companies world over have achieved the decacorn status. India has five startups namely, Flipkart, BYJU’s, Nykaa and Swiggy, added in decacorn cohort.

Source: https://inc42.com/the-indian-unicorn-tracker/

- English English

- தமிழ் தமிழ்

- বাংলা বাংলা

- മലയാളം മലയാളം

- ગુજરાતી ગુજરાતી

- हिंदी हिंदी

- मराठी मराठी

- Business Business

- बिज़नेस बिज़नेस

- Insurance Insurance

The Financial Express

- Share Market Live

- Q4 Results 2024

- JEE Advanced 2024 Admit Card

- Mutual Funds

- Stock Market Stats

- Gold Rate Today

- Top Indices Performance

- Brandwagon Summit 2024

- Loksabha Election

- Budget 2024

- Stock Market Quotes

- Mutual Fund

- Stock Stats

- Top Gainers

- CaFE Invest

- Investing Abroad

- Gold Rate in India

- Silver Rate in India

- Petrol Rate in India

- Diesel Rate in India

- Express Mobility

- Banking & Finance

- Travel & Tourism

- Brand Wagon

- Entertainment

- Web Stories

- Auto Web Stories